Workers’ Compensation

Subsequent Injury Benefits Trust Fund Ballooning Out of Control

California’s workers’ compensation system is rooted in an agreement between employers and employees, sometimes referred to as the “The Grand Bargain.” Under the Grand Bargain, employers accept responsibility for all injuries and illnesses that occur in the course and scope of employment, even when they would otherwise have no legal liability. Employees, in exchange for the guaranteed coverage, relinquish the right to sue their employers in civil court.

In the early 20th Century, some states established a subsequent injury fund as part of their workers’ compensation system. The intent was to compensate workers above and beyond the standard benefits where their injury was exacerbated by a pre-existing condition and their permanent disability (PD) rating is higher than it would have been absent that pre-existing condition. California created its fund, now called the Subsequent Injuries Benefits Trust Fund (SIBTF), in 1945. It was motivated in part by veterans who had been injured in the World Wars and were beginning to reenter the workforce. The SIBTF is funded by annual workers’ compensation assessments paid by all California employers.

Eligibility Requirements

Pursuant to Labor Code Section 4751, a worker is eligible for benefits from the SIBTF if they meet the following requirements:

1) The worker had one or more pre-existing permanent partial disabilities that were “labor disabling” at the time of the injury, meaning that it could have been the basis for a workers’ compensation claim had it been caused by work.

2) The worker suffered a subsequent injury compensable under the workers’ compensation system.

3) The PD resulting from the combination of the pre-existing disability and the subsequent injury is greater than the PD resulting from the subsequent injury alone.

4) The PD rating described in number 3 is at least 70%.

5) The PD rating resulting from the subsequent injury alone (without adjustment for age or occupation) was either: a) at least 35% or b) at least 5% and affected a hand, arm, foot, leg, or an eye that is “opposite and corresponding” to a body part with a pre-existing condition

So, for example, if a worker had a pre-existing injury to their back and subsequently suffered an injury at work that exacerbated their back injury, they may be entitled to benefits from the SIBTF if the PD rating of the two injuries combined is more than 70% and the subsequent injury rating was at least 35%.

California’s SIBTF Claims Skyrocket

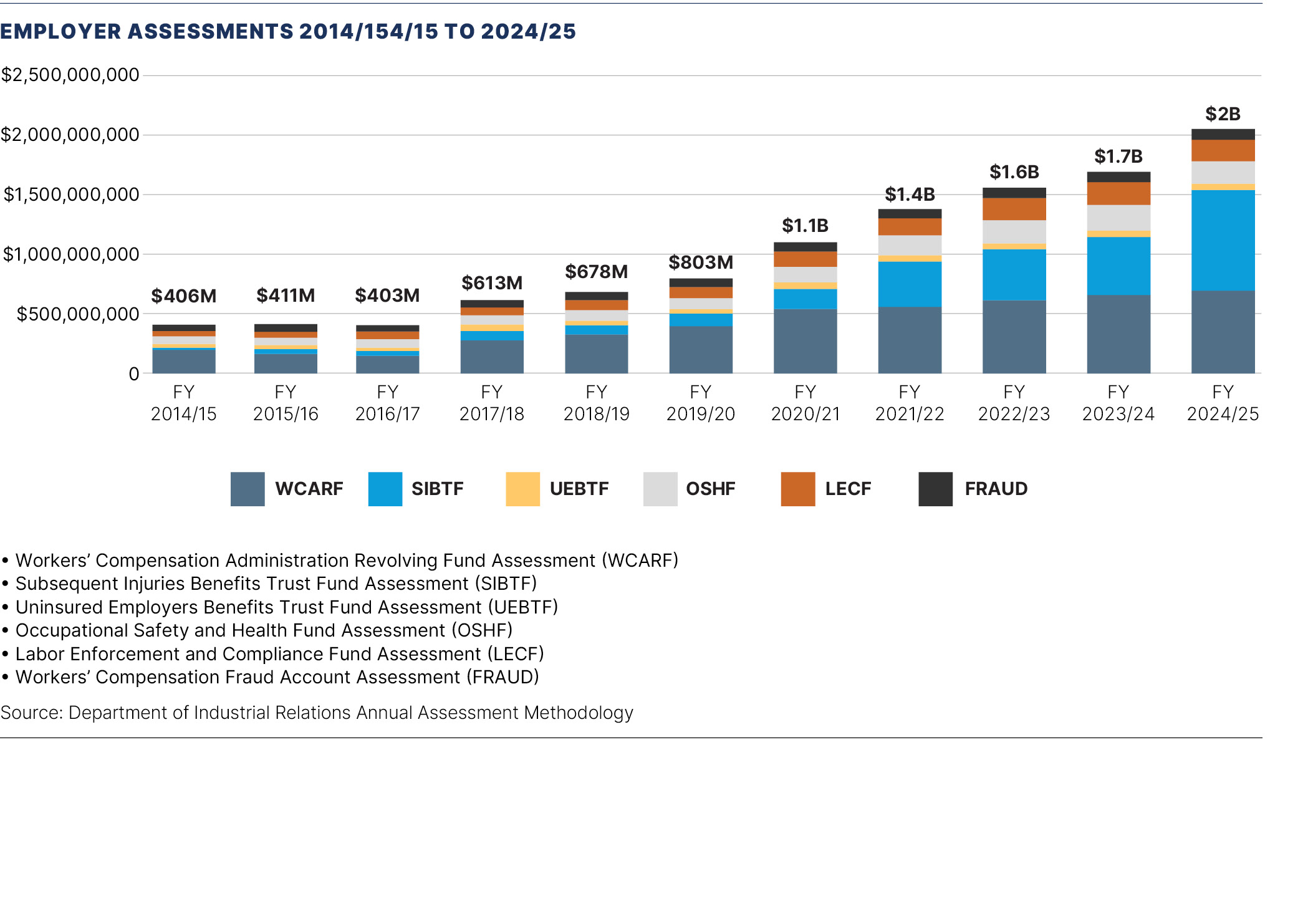

California’s SIBTF has garnered attention in recent years due to sharp increases in claims filed and benefits paid. The number of annual SIBTF applications has tripled since 2015, with nearly 2,500 claims being filed in 2022. Benefits paid from the SIBTF rose from approximately $115 million per year to more than $600 million per year and it is estimated that the liability resulting from existing unresolved cases is greater than $5 billion. This growth has contributed to the skyrocketing of employer workers’ compensation assessments each year.

Because of those significant increases, the California Department of Industrial Relations (DIR) contracted with RAND to examine the SIBTF and propose possible policy solutions. That report was released in June 2024. Several items of note include:

Common Conditions Being Claimed

Since the creation of the SIBTF, there has not been much limitation on what type of condition qualifies for an application. Although some states limit qualifying pre-existing conditions to a specific list, California does not. Therefore, over time, there has been an increased trend in many of the pre-existing conditions claimed being common, chronic conditions that come with aging, such as arthritis, headaches, diabetes and obesity.

Change in Case Law Regarding PD Calculation

One reason for the trend was a 2020 decision in Todd v. SIBTF. That decision changed how the permanent disability rating was calculated for purposes of SIBTF claims, making it much easier to reach a 100% rating. When an applicant has a 100% rating, the amount of benefits to which they are entitled skyrockets. This has resulted in a significant increase in the benefits being paid out per case and a lack of parity between SIBTF fund recipients and applicants without a pre-existing condition. As RAND explains:

“In practice, the fact that workers can reach a 100-percent rating and receive generous PTD [permanent total disability] benefits more easily through the additive method than through the combined values method means that workers who would be determined to be less severely disabled by other parts of the system (e.g., for their work injuries alone) will be receiving more generous benefits from SIBTF. In other words, a worker with multiple alleged PPDs [permanent partial disabilities] who is evaluated for SIBTF will likely receive far more generous benefits than a worker with the same set of alleged disabilities if they all resulted directly from an industrial injury.”

Increase in Volume of Medical Legal Reports Per Case

SIBTF cases also involve their own medical-legal process. Standard claims are subject to a regulated qualified medical evaluator (QME) process and SIBTF claims are not, resulting in costs being paid out to medical examiners and copy services. There are financial incentives to either order multiple reports or to use specific examiners, which is evidenced by the fact that certain vendors are used far more frequently. RAND estimates that about $1 of every $5 paid by the SIBTF between 2010 and 2022 went to medical-legal reports rather than workers. (RAND report, p. 88.) There also is no firm statute of limitations, so an SIBTF claim can be filed years after the subsequent injury occurs, complicating the ability to accurately evaluate a claim and reliability of medical reporting.

Are Changes to SIBTF on the Horizon?

DIR’s decision to commission the RAND study is telling that the administration sees this as a growing issue. Employers have noticed as well, especially as far as the impact of the fund on employer assessments. (See chart)

The RAND report demonstrates that the increased use of the fund is not because of a change in working conditions, but rather because of the relative ease of claiming chronic conditions and availability of increased benefits under Todd.

Interestingly, 18 jurisdictions, including Colorado, Connecticut, New Mexico, and the District of Columbia, have discontinued their funds or allowed them to sunset. Some have cited growing financial liability and some have cited a lack of evidence of the need of such a fund considering the enactment of anti-discrimination laws like the Americans With Disabilities Act of 1990.

CalChamber Position

California will soon need to decide whether it too should eliminate the SIBTF or address some of the challenges highlighted by the RAND report. The California Chamber of Commerce supports system changes that will reduce employers’ annual assessments, but also cautions that any reforms should be thoughtful so that there are no unintended consequences that drive up system costs elsewhere or encourage additional litigation.

February 2025

Recent News

Workers’ Compensation Bills

Coalitions

- California Employers Coalition

- Workers’ Compensation Action Network (WCAN)

- California Coalition on Workers’ Compensation (CCWC)

Committees

Staff Contact

Ashley Hoffman

Ashley Hoffman

Senior Policy Advocate

Labor and Employment, Workers’ Compensation