Trade Statistics

California is one of the 10 largest economies in the world with a gross state product of over $4 trillion. International trade and investment are major parts of our economic engine that broadly benefit businesses, communities, consumers and state government. California’s economy is diverse, and the state’s prosperity is tied to exports and imports of both goods and services by California-based companies, to exports and imports through California’s transportation gateways, and to movement of human and capital resources.

According to the International Monetary Fund’s 2024 World Economic Outlook data released April 22, 2025, California’s nominal GDP reached $4.1 trillion, surpassing Japan’s $4.02 trillion, and placing California behind only the United States, China, and Germany in global rankings.

Although trade is a nationally determined policy issue, its impact on California is immense. In 2024, California exported to over 225 foreign markets. Trade offers the opportunity to expand the role of California’s exports. In its broadest terms, trade can literally feed the world and raise the living standards of those around us.

According to the United Nations, global trade hit a record high of $33 trillion in 2024, expanding 3.7% ($1.2 trillion). Most regions saw positive growth, except for Europe and Central Asia. The services trade led the expansion in 2024, which grew 9% annually and adding $700 billion. Goods trade grew slower at 2%, and contributing $500 billion, but both goods and services trade slowed the second half of 2024, with services slowing to 1%, and goods at 0.5%. This is even as we saw merchandise trade imbalances widen, as the U.S. trade deficit with China reached -$295.5 billion, and the U.S. deficit with the EU increased by $12 billion to -$241 billion.

Trade has remained stable into early 2025, but uncertainty is being felt globally, as protectionist policies, trade disputes and geoeconomic tensions grow, with disruption being foreseen in the future. This is being felt in supply-chain dependent sectors as indicators are showing weaker industrial activity.

|

2024 Trade Statistics are available |

| U.S. International Trade in Goods and Services, February 2025 Bureau of Economic Analysis, April 3, 2025 |

International Activities

Global Trade Facts

The world population as of April 2025, is 8.1 billion people. As of January 2024, one birth is expected every 9 seconds, and one death every 10 seconds worldwide in 2025. (U.S. Census Bureau, December 2024)

In 2023, the World Trade Organization saw merchandise trade slump by 1.2 percent after growing by 3 percent the year prior, with many countries facing increased energy costs and inflation as the causes. These costs reduced real incomes for households, and increased business costs such as production and borrowing. This decline was slightly offset by the resilient growth in the services trade sector, which increased by 9 percent globally and is mostly attributed to the growth in tourism since the end of the Covid-19 pandemic.

The WTO recognized that despite the pandemic, trade tensions, and political uncertainty in many parts of the world, that world trade has continued to be strong. Goods and services trade saw a $30.4 trillion high with merchandise trade up by 6 percent compared to their pre-pandemic levels in 2019. They expect goods trade to continue to recover moderately in 2024 and 2025, as inflation eases, and household incomes are lifted.

The WTO’s forecast of merchandise trade is expected to increase by 2.7 percent in 2024 and 3 percent in 2025, with demand for traded goods being weaker than expected in Europe, but stronger in Asia. Commercial services, digitally delivered services, also see a positive outlook as they have risen at about 51 percent between 2019- 2025. World real GDP growth is expected to remain steady at 2.7% between 2023 and 2025, output is expected to be highest in Asia, where it is expected to climb 4 percent, while Europe has been marked as the slowest growing region, with output projected to be around 1.1 percent.

There are large risks to this forecast, with their outlook report noting rising protectionism, monetary policy divergence, and increasing geopolitical tensions and regional conflict, specifically in Europe and the Middle East. These conflicts have been observed to creating increasing signs of fragmentation in trade flows, and policymakers approach to these, whether too aggressive or too cautious, can either create economic slowdown or risk a return to rising inflation. Other risks noted were price shocks and climate related weather incidents.

Despite this, inflation had fallen by the middle of 2024, which saw central banks cutting interest rates. This should boost consumer spending and raise real household incomes. This should also raise investment spending by firms.

The IMF projects the world economy to grow at 3.3% for 2025 and 2026 which is below the historical average of 3.7%. Unchanged from the 2024 projection in October, the 2025 projection will fall along similar lines as U.S. influence shakes other economies. Global inflation is set to decline by 4.2% in 2025 and 3.5 % in 2026, targeting more developed economies. Policy generated disruptions are a key risk, as they can disrupt the easing of monetary policy. The IMF highlighted that sharp policy focus on the balancing of “trade-offs between inflation and real activity, rebuilding buffers, and lifting medium-term growth prospects through stepped up structural reforms as well as stronger multilateral rules and cooperation.” (IMF)

Energy commodity prices are expected to decline by 2.6%, more than previously predicted in October 2024, mostly due to weak Chinese demand and more supply from OPEC+ countries. Commodity prices (non-fuel) are expected to go up 2.5% in 2025, due to revisions of food and beverage prices, and monetary policies are expected to continue to decline, but at different places. Meanwhile, fiscal policies are expected to tighten, mostly in developed economies like the U.S., while less developed and emerging economies are expected to as well, but at a slower pace.

World Trade Statistical Review

U.S. Trade Facts

In 2024, combined goods and services exports totaled $3.2 trillion, with goods totaling $2.08 trillion and services totaling $1.11 trillion individually. Services saw a surplus of $293.3 billion an increase of $14.9 billion, and while the goods deficit grew 14%, we saw an increase of $38.6 billion in goods exports.

In 2024, combined goods and services imports totaled $4.1 trillion, individually goods imports totaled $3.3 trillion, and imports of services totaled $814.4 billion.

The increases in both goods exports and imports reflected increases in all major components, led by computer and electronic products.

The goods and services deficit was 3.1 percent of current-dollar gross domestic product in 2024, up from 2.8 percent in 2023.(Bureau of Economic Analysis)

The United States is the world’s largest economy with a projected GDP of $28.27 trillion in 2024, according to the Bureau of Economic Analysis. The population of the U.S. is approximately 341.6 million.

The U.S. Commercial Service, a branch of the U.S. International Trade Administration, reported $109 billion in U.S. export revenue through their services as of 2024, with more than 100 facilities in over 80 countries worldwide to help with exporting needs for small to medium-sized businesses. With around 92,800 clients, they helped to support over 482,900 U.S. jobs.

A 2020 study from the Business Roundtable reported that more than 40 million, or 1-in-5, jobs in the U.S. stem from international trade practices. The number of U.S. jobs that depend on international trade has more than doubled since NAFTA’s inception in 1992, reaching 20% in 2018.

The largest export markets for U.S. goods in 2024 were Canada ($348.5 billion), Mexico ($334.04 billion), China ($143.55 billion), Netherlands ($89.65 billion), and The United Kingdom ($79.94 billion).

Until just a few years ago, China was easily the largest U.S. trading partner, where individual countries were concerned. But it’s fallen to third place behind Canada and Mexico, as the result of the increased trade friction that began in the first Trump administration and prompted companies to diversify their supply chains. The 27 nations of the European Union can also collectively stake a claim to being the largest U.S. trading partner, with exports totaling $370.2 million.

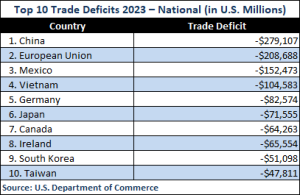

Despite this, The U.S. still has a large trading deficit with China, with it being roughly -$295.4 billion in 2024. Nationally the U.S. also has trading deficits with Mexico, the EU, Canada and Vietnam, some of its largest trading partners.

Despite this, The U.S. still has a large trading deficit with China, with it being roughly -$295.4 billion in 2024. Nationally the U.S. also has trading deficits with Mexico, the EU, Canada and Vietnam, some of its largest trading partners.

In the U.S. in 2023, according to the Bureau of Economic Analysis, expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $148.8 billion, a decrease of $57.4 billion (28%) from 2022 revised total of $206.2 billion, and below the annual average of $265.6 billion from 2014-2022.

By industry the largest amounts were in transportation and warehousing, but these values are suppressed due to confidentiality requirements. The manufacturing sector came in at $42.9 billion and had accounted for 28.8% of total expenditures. In the manufacturing category, expenditures were the largest in chemical manufacturing ($17.8 billion) and electrical equipment, appliances, and components ($6.6 billion). Also, notable expenditures were in professional, scientific, and technical services ($16.0 billion). BEA

By country of ultimate beneficial owner (UBO), the largest investing country was Canada, with expenditures of $53.4 billion. Japan ($14.6 billion) was the second-largest investing country, followed by Sweden ($8.4 billion). By region, Europe contributed 33.8 percent of new investment in 2023.

By state, in 2023, California had received the second largest expenditures totaling $12.8 billion. In 2021, California received the most investment, totaling $64.1 billion. (Bureau of Economic Analysis)

Statistics released in August of 2024, showed employment in the United States by U.S. parent companies increased 2.5% to 30.2 million workers in 2022. U.S. parent companies accounted for 22.6 % of total private industry employment in the U.S. in 2022, below the 23.1% in 2021. Employment by U.S. parents was largest in manufacturing, in retail trade, and in “other industries,” which had transportation and warehousing leading. Total value added by majority-owned foreign affiliates was largest in the United Kingdom, Canada, and Ireland. (Bureau of Economic Analysis)

For more info on international trade in goods and service.

Source: Bureau of Economic Analysis

California Trade Facts

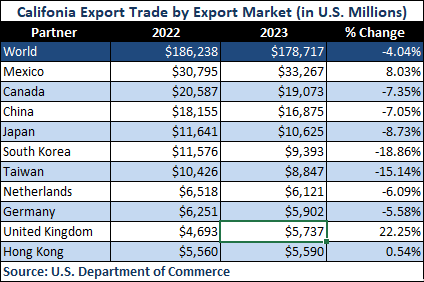

The U.S. Department of Commerce reported that, in 2024, California goods exports amounted to $183.34 billion. This was an increase of roughly 2.5% from the previous year’s total of $178.84 billion.

In 2024, exports to FTA markets accounted for 43.01% of California exports. California exports to FTA partners totaled $78.86 billion in 2024. (ITA)

Goods exports from California accounted for roughly 8.9% of total U.S. goods exports in 2024. California exports translate into jobs for around 582,000 Californians (from current data available), which can pay up to an estimated 18 percent above the national average according to the United States Trade Representative.

In 2023 (current data available), there were an estimated 18,484 foreign-owned enterprises (FOEs) operating in California, employing 800,084 residents, amounting to $84.2 billion in wages. Top sources of FDI by foreign-owned enterprises were the United Kingdom, Japan, France, Canada, Germany, and Switzerland. The top industry sectors for FOEs were natural resources, construction, manufacturing, wholesale trade, retail trade, and transportation/warehousing/utilities. (LAEDC)

Top Export Sectors

California is one of the top exporters in the nation of computers and electronic products, non-electrical machinery, transportation equipment, chemicals, and agricultural products. Computers and electronic products are California’s top exports coming in at $47.89 billion.

Mexico

Mexico continues to be California’s No. 1 export market. California exports to Mexico totaled $33.52 billion in 2024. Exports increased by 0.8% compared to 2023. Mexico purchases 18.3% of all California goods exports.

California’s exports to Mexico are driven by computers and electronic products, which account for 19.8% of all California exports to Mexico. Other top categories included transportation equipment, chemicals and non-electrical machinery.

Canada

Canada is California’s second largest export market, purchasing 10.01% of all California exports. In 2024, California exported more than $18.36 billion to Canada. Exports to Canada decreased by 5.27% in 2024 compared to 2023.

Computers and electronic products remained California’s largest exports, accounting for 24.95% of all California exports to Canada.

Asia

California is the second largest exporting state to Asia, after Texas. In 2024, California exported $71.893 billion in goods to the region.

Greater China

California exports to Mainland China totaled $15.092 billion in 2024, a 10.5% decrease from the year before. Computers and electronic products were the largest export to China accounting for 22.5% of exports.

Exports to Hong Kong were $5.56 billion in 2024, an increase of 0.04% from the previous year. Hong Kong was California’s 9th largest export market.

Japan

California exports to Japan totaled $10.87 billion in 2024. Exports increased by 2.57% between 2024 and 2023. Computers and electronic products accounted for 18.9% of total exports.

Taiwan

Taiwan took the spot as the 5th largest export market for California in 2024, with exports totaling $9.56 billion, an 8.05% increase from the previous year. Computer equipment was the top export at $4.116 billion, 43.05% of total exports.

European Union

California exports to the European Union (excluding the UK) totaled $28.02 billion in 2024. California is a second-top exporting state to Europe.

Computers and electronic products, chemicals, miscellaneous manufactures, and agricultural products are California’s leading export sectors to the region. European Union countries purchase about 15.3% of all California exports.

Export Totals from California

In 2024, California exported $183.343 billion to over 225 foreign economies. California’s top export markets are Mexico, Canada, China, Japan and Taiwan.

Import Totals from California

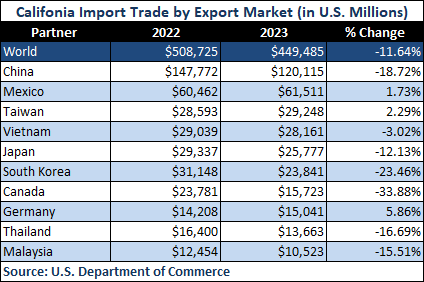

In 2024, California imported $491.478 billion worth of goods from the world. California’s top sources of imports are China, Mexico, Taiwan, Vietnam and South Korea.

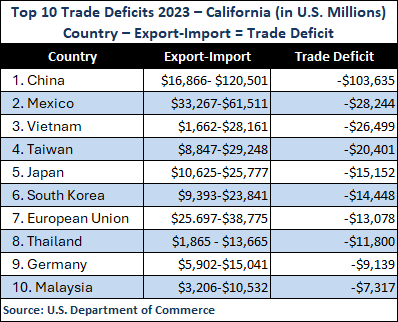

Trade Deficits for California

California experienced trade deficits in 2024, with trade with China having the largest deficit at -$107.668 billion. Other trade deficits with trading partners for California included Mexico, Vietnam, Taiwan, Japan, South Korea, the EU, Thailand, Germany and Malaysia.

California experienced trade deficits in 2024, with trade with China having the largest deficit at -$107.668 billion. Other trade deficits with trading partners for California included Mexico, Vietnam, Taiwan, Japan, South Korea, the EU, Thailand, Germany and Malaysia.

It should be noted that California has a goods trade surplus with Canada (+$2.1 billion) while the national goods trade balance with Canada is at a deficit of -$64.19 billion, according to data from the U.S. Department of Commerce.

USMCA Tracker Data Tool from the Brookings Institute

War Dims Global Economic Outlook as Inflation Accelerates

International Monetary Foundation, April 19, 2022

World Bank Cuts 2022 Global Growth Outlook on Russia Invasion

Bloomberg, April 18, 2022

Global Economic Uncertainty, Surging Amid War, May Slow Growth

International Monetary Foundation, April 15, 2022

Addressing Challenges to Growth, Security and Stability – Scene-Setter Speech by World Bank Group President David Malpass

World Bank, April 12, 2022

Trade and American Jobs: The Impact of Trade on U.S. and State-Level Employment: 2022 Update

Business Roundtable, February 2022

Mad About Trade: Why Main Street America Should Embrace Globalism

CATO Institute

Cato Institute Project on Jones Act Reform

CATO Institute

WTO Trade Statistics 2019 Editions

Additional Information

- California Agriculture Export Data – CDFA & UC Davis

- California Dept of Finance – California Trade Data

- California Dept of Finance – Economic Indicators

- California Travel & Tourism Commission – International Travel Reports

- California Tourism Facts and Figures

Visit California - InvestAmerica

- Organization for International Investment

- Trade and American Competitiveness Coalition Statistics

- Trade Partnership Worldwide

- U.S. Bureau of Labor Statistics – California Economic Data

- U.S. Bureau of Transportation Statistics

- U.S. Census Bureau Foreign Trade Statistics

- U.S. Department of Agriculture – California Economic Data

- U.S. Department of Commerce – California Trade Stats

- U.S. Department of Commerce – TradeStatsExpress

- U.S. Department of Commerce – U.S. Census Bureau Trade in Goods and Services (pdf)

- U.S. Department of Commerce – Trade and Economic Analysis

- U.S. Waterborne Import-Export Trade Data

- Wiser – Foreign Trade Database

- World Trade Organization – Country Trade Profiles