Foreign Direct Investment

SelectUSA is a U.S. government-wide program led by the U.S. Department of Commerce. Since its inception, SelectUSA has facilitated more than US$270 billion in investment, creating and/or retaining over 240,000 U.S. jobs.

SelectUSA’s mission is to facilitate job-creating business investment into the United States and raise awareness of the critical role that economic development plays in the U.S. economy.

SelectUSA assists U.S. economic development organizations to compete globally for investment by providing information, a platform for international marketing, and high-level advocacy. SelectUSA also helps companies of all sizes find the information they need to make decisions, connect to the right people at the local level, and navigate the federal regulatory system.

Select USA’s Foreign Direct Investment in California Factsheet

BEA’s economists produce some of the world’s most closely watched statistics, including U.S. gross domestic product, better known as GDP. We do state and local numbers, too, plus foreign trade and investment stats and industry data. The Bureau of Economic Analysis (BEA) promotes a better understanding of the U.S. economy by providing the most timely, relevant, and accurate economic accounts data in an objective and cost-effective manner. BEA is one of the world’s leading statistical agencies. Although it is a relatively small agency, BEA produces some of the most closely watched economic statistics that influence the decisions made by government officials, businesspeople, households, and individuals. BEA’s economic statistics, which provide a comprehensive, up-to-date picture of the U.S. economy, are key ingredients in critical decisions affecting monetary policy, tax and budget projections, and business investment plans. BEA : Interactive Data

Impacts of Foreign Direct Investment in the U.S. Economy

The United States is the world’s largest recipient of foreign direct investment. Foreign direct investment impacts the U.S. economy in many positive ways. For example, FDI:

- Creates New Jobs

- Boosts Wages: U.S. affiliates of foreign companies tend to pay higher wages than the US average.

- Increases U.S. Exports: U.S. companies use multinationals’ distribution networks and knowledge about foreign tastes to export into new markets.

- Contributes to Rising U.S. Productivity: Inward investment leads to higher productivity growth through an increased availability of capital and resulting competition. Productivity is a key factor that increases U.S. competitiveness abroad and raises living standards at home.

- Strengthens U.S. Manufacturing.

- Brings in New Research, Technology, and Skills.

FDI Resources:

In California:

Foreign Direct Investment in California – 2025

World Trade Center – Los Angeles

California Business Investment Guide

Governor’s Office of Business and Economic Development, September 2024

Governor’s Office of Business and Economic Development (GO-Biz)

California welcomes foreign investment. Services for foreign investors include site selection, logistical assistance, demographic/wage/tax/utility cost data, quality of life facts for workers and families, and networking opportunities. GO-Biz provides resources on popular incentives including tax credits, training panels and other programs. They offer incentives for investors to get started in California.

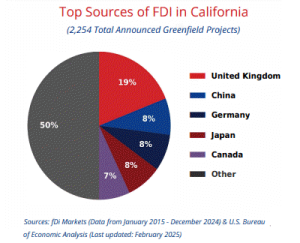

Top Sources of FDI in California

California Foreign Direct Investment: Tech Guide

California Association for Local Economic Development, 2023

U.S. Resources:

Committee on Foreign Investment in the United States (CFIUS)

The Committee on Foreign Investment in the United States (CFIUS) is an inter‐agency committee authorized to review transactions that could result in control of a U.S. business by a foreign person (“covered transactions”), in order to determine the effect of such transactions on the national security of the United States. CFIUS operates pursuant to section 721 of the Defense Production Act of 1950, as amended by the Foreign Investment and National Security Act of 2007 (FINSA) (section 721) and as implemented by Executive Order 11858, as amended, and regulations at 31 C.F.R. Part 800.

CFIUS and the U.S. Department of the Treasury releases an annual report to Congress. This mandated report consists of a review of inward Foreign Direct Investment in relation to national security and the investigations conducted during the year.

U.S. Government Accountability Office (GAO)

The U.S. Government Accountability Office (GAO) is an independent, nonpartisan agency that works for Congress. Often called the “congressional watchdog,” GAO investigates how the federal government spends taxpayer dollars. The head of GAO, the Comptroller General of the United States, is appointed to a 15‐year term by the President from a slate of candidates Congress proposes. Gene L. Dodaro became the eighth Comptroller General of the United States and head of the U.S. Government Accountability Office (GAO) on December 22, 2010, when he was confirmed by the United States Senate. He was nominated by President Obama in September of 2010 from a list of candidates selected by a bipartisan, bicameral congressional commission. He had been serving as Acting Comptroller General since March of 2008.

U.S. Office of Information and Regulatory Affairs (OIRA)

The Office of Information and Regulatory Affairs (OIRA) is a statutory part of the Office of Management and Budget within the Executive Office of the President. OIRA is the United States Government’s central authority for the review of Executive Branch regulations, approval of Government information collections, establishment of Government statistical practices, and coordination of federal privacy policy. The office is comprised of five subject matter branches and is led by the OIRA Administrator, who is appointed by the President and confirmed by the United States Senate.

Global Business Alliance (Formerly the Organization for International Investment (OFII))

As the premier advocacy resource for international companies in the United States, the Global Business Alliance (GBA), formerly known as the Organization for International Investment (OFII), actively promotes and defends an open economy that welcomes international companies to invest in America. Our members are American companies with global heritage and an indispensable part of our nation’s economic success. When America is open for business, we all benefit.

FDI Facts:

FDI Glossary

U.S. foreign direct investment (FDI) is defined as the ownership or control, directly or indirectly, by one foreign

person, or entity, of 10 percent or more of the voting securities of an incorporated U.S. business enterprise or

an equivalent interest in an unincorporated U.S. business enterprise.

For more key foreign direct investment terms and concepts click here. (SelectUSA)

Facts About International Investment

(U.S. Chamber of Commerce)

- International investment drives U.S. economic growth

- Investment from abroad creates millions of American jobs

- Companies that invest abroad are great employers for American workers

- Investing abroad makes American companies resilient

- U.S. companies invest in foreign markets to serve those markets – not as a substitute for domestic production

- International investment is a powerful driver of U.S. exports

- Earnings from foreign investments help U.S. companies innovate here at home

- Earnings U.S. multinational companies are overwhelmingly focused on the U.S.

- Most U.S. investment abroad goes to developed countries with higher wages and labor standards

- Investors from abroad a big buyers locally

Recent News:

Foreign Direct Investment in California – 2025

World Trade Center Los Angeles & GO-Biz, 2025

Fact Sheet: President Donald J. Trump Secures $200 Billion in New U.S.-UAE Deals and Accelerates Previously Committed $1.4 Trillion UAE Investment

The White House, May 15, 2025

Fact Sheet: President Donald J. Trump Secures Historic $1.2 Trillion Economic Commitment in Qatar

The White House, May 14, 2025

Fact Sheet: President Donald J. Trump Secures Historic $600 Billion Investment Commitment in Saudi Arabia

The White House, May 13, 2025

Foreign Direct Investment in California- 2024

World Trade Center Los Angeles & GO-Biz, 2024

Activities of U.S. Affiliates of Foreign Multinational Enterprises in 2022

Bureau of Economic Analysis, December 10, 2024

Report: Foreign Direct Investment in California, 2023

World Trade Center Los Angeles & GO-Biz, 2023

New Foreign Direct Investment in the United States, 2021

Bureau of Economic Analysis, July 6, 2022

Investment Trends Monitor: 2020 H1 FDI Down 49%. Biggest Declines in Europe and the United States. Outlook Negative as New Project Announcements Drop 37%.

UNCTAD, October 2020