Way to a More Prosperous California

High Cost of Public Policies Shadows Post-Pandemic Recovery

The Golden State has arguably generated more economic success and opportunity than any society on earth.

California’s total economic output, ranking fifth globally, tops India and rivals Japan. On a per capita basis, California’s output is ninth, just behind Switzerland. Over the past 60 years, California has grown a third faster than the rest of the United States, and our economy has grown from 10% to 14% of the overall U.S. economy.

Threats to Growth

But the state’s ability to maintain this trajectory of growth is severely threatened by the related issues of affordability and population growth.

Since 2018, California’s economic, employment and income growth have all trailed the nation. After a decent bounce back from the pandemic, California has underperformed economically.

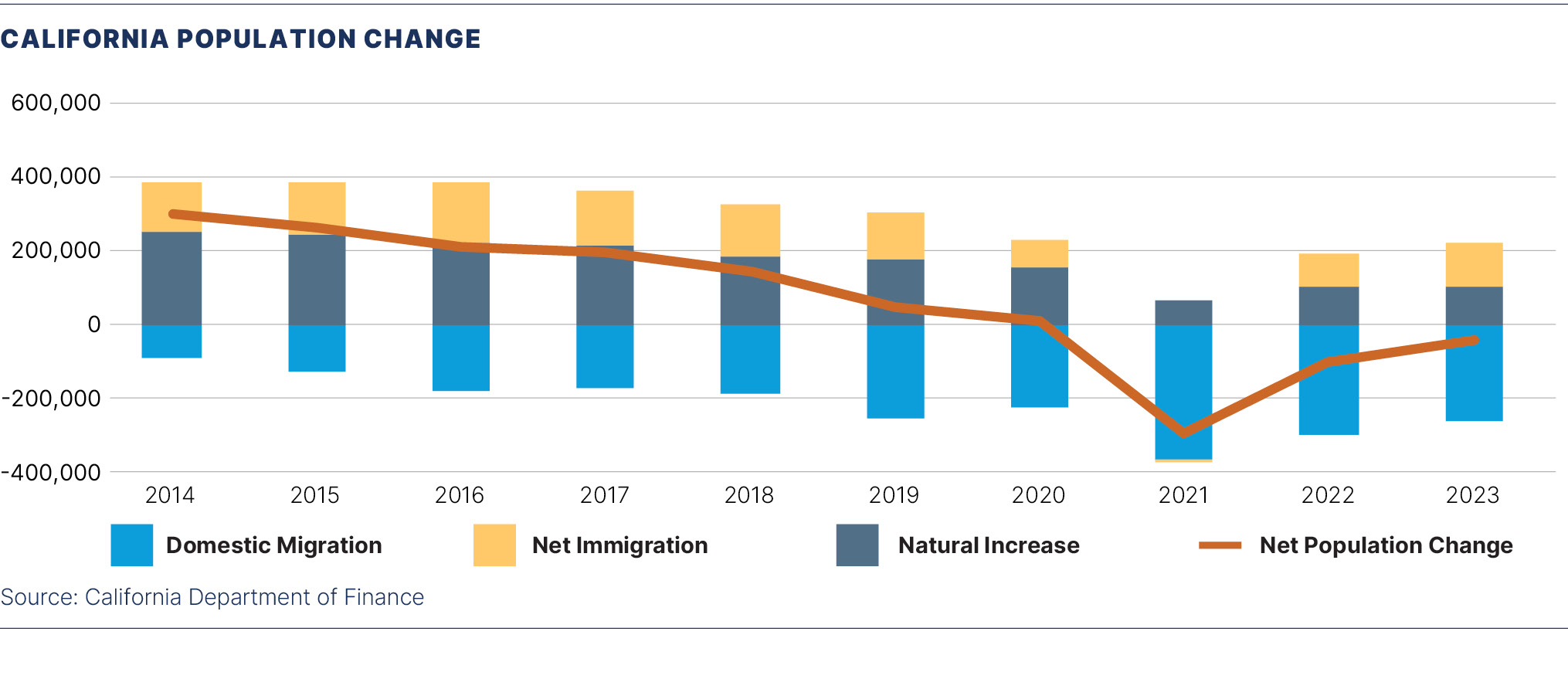

California’s population has decreased by about a half million residents since 2020, or about 1.4%.

California may be one of the greatest prosperity generators the world has ever seen. But even so, it’s often no match for the toll that the state’s relentless cost of living takes on affordability for working and middle-income families. This crisis of affordability — much of it a result of or exacerbated by public policy — is the clearest and most immediate threat to continuing the California dream.

Affordability Crisis

In some ways, the great success of California sowed the seeds of the affordability crisis. Economic growth, the international renown of our high tech, biotech, entertainment and agricultural sectors, and our world class higher education systems, to name a few — these accomplishments can cloud the judgment of elected leaders, leading them to treat California as a “luxury good,” deluding them to believe residents are willing to pay an ever-increasing cost to live here. This attitude can give rise to expensive and divisive policy initiatives that serve political constituencies and cultural trends, but which do not necessarily register with residents and taxpayers.

It costs a lot to make a life in the Golden State.

The good news is that California family income growth has kept up with the nation. Since 2011, median inflation-adjusted household income increased by 68% in California, compared with 61% nationally. Hourly wages in California for private sector workers are about one-sixth higher in California than in the nation, and have climbed by 40% over the past decade, compared with a 35% increase nationally.

The typical family and worker is making more in California, which is a good thing, because it sure costs more to live here.

Housing Costs Growing

The biggest expense for most Californians is housing, and every year costs grow for both prospective homeowners and renters. California housing costs are infamous nationally and are perhaps the biggest selling point for workers when workplaces are expanded or moved outside of the state.

According to the Public Policy Institute of California (PPIC), since 2014, California has experienced net losses of almost 700,000 adults who cite housing as the primary reason. The PPIC Statewide Survey has found that 34% of Californians have seriously considered leaving the state because of high housing costs.

But most dispiriting is that the cost of housing is among the greatest contributors to poverty in California. Homeownership rates in California are among the lowest in the country. Owning a home is the leading source of wealth for most families, and over the long run provides families with more stable and lower housing costs compared to renting. Yet — primarily because of the state’s high housing prices — homeownership is out of the reach of many Californians.

The modest efforts to increase supply that have been enacted at the state level have been more than offset by sharp increases in state and local regulations. These well-intentioned but misguided mandates include limits on rental price increases, a widespread use of eviction moratoriums, a failure to prioritize market rate units for permitting, and even going so far as taxing the supply of new housing (so-called linkage fees) to subsidize incredibly expensive affordable housing units. Fortunately, voters have rejected statewide rent control authority three times over the past decade, cognizant that this policy is far more likely to shrink housing supply than expand it.

Energy Costs

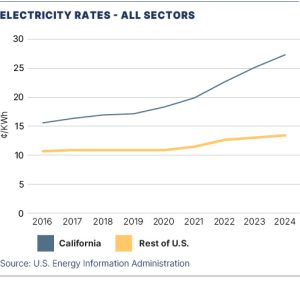

In addition to the high cost of housing, Californians also face a “luxury tax” on other essentials. The state has among the highest utility rates and gasoline prices in the nation, much of it a direct result of public policy. The bill is coming due for the two-decade long push by California’s elected officials to make California a world leader in addressing the sources of climate change. The resulting policies have created real-world costs for Californians.

In addition to the high cost of housing, Californians also face a “luxury tax” on other essentials. The state has among the highest utility rates and gasoline prices in the nation, much of it a direct result of public policy. The bill is coming due for the two-decade long push by California’s elected officials to make California a world leader in addressing the sources of climate change. The resulting policies have created real-world costs for Californians.

Californians pay the second-highest retail prices for electricity in the nation in every sector, trailing only Hawaii. For the residential and commercial sectors, California’s end-use electricity rates are twice as high as the national average. Rates for industrial uses are nearly three times the national average.

State leaders recognized this phenomenon in 2024, although substantive action has been taken to address costs. Governor Gavin Newsom issued an executive order at the end of October 2024, directing executive and regulatory agencies to examine the benefits and costs to electric ratepayers of programs they oversee with an eye toward “modifying or repealing any statute that would reduce costs to electric ratepayers without compromising public health and safety, electric grid reliability, or the achievement of the state’s 2045 clean electricity goal and the State’s 2045 economywide carbon neutrality goal.” Many legislators also are raising the alarm over the affordability of energy costs.

As of November 2024, California motorists paid about 55 cents per gallon in hidden “carbon” fees, on top of the state’s nation-leading gasoline and diesel taxes. The carbon fees will likely increase substantially from changes to the “Low Carbon Fuel Standard” recently adopted by the Air Resources Board. The Board originally estimated the new regulations would increase the price of gasoline up to 47 cents/gallon but withdrew that estimate and has not updated it.

The clock is ticking toward the prohibition on sales of new gasoline-powered cars in 2035, and many cities are moving to ban the construction of new gasoline stations, as well as limiting new use of natural gas for residential heating and cooking, and for restaurants.

In addition to targeting the internal combustion engine, state and local officials want to reduce vehicle use no matter the fuel technology. Local governments and regional planning agencies are considering tools to discourage automobile use like fees on housing based on homeowners’ projected road use, as well as “road diets” to reduce street lanes. The Air Resources Board’s Scoping Plan for carbon reduction eyes reducing vehicle miles traveled per capita by 25% below 2019 levels by 2030, and 30% by 2045.

Taxation

California’s tax burden includes the highest income and sales taxes in the country, and very high corporate and gasoline taxes.

Meanwhile, the cost of employing workers continues to rise.

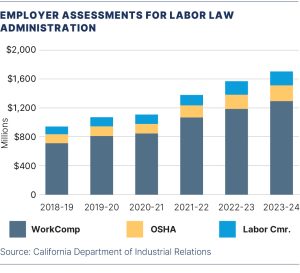

Employers are responsible for 100% of taxes to pay for unemployment insurance and assessments to support administration for workers’ compensation, worksite health and safety and labor law enforcement programs. In addition, employers are responsible for paying premiums for mandatory workers’ compensation insurance coverage.

The costs to support these programs are becoming … insupportable.

Massive unemployment (16.1% in California) from business closures during the 2020 pandemic forced the unemployment insurance (UI) fund into insolvency. California was one of only a handful of states in the red that chose not to use federal relief funds to offset the UI debt, which peaked in late 2021 at approximately $20 billion. As a result, employer taxes have been increasing annually by $21 per employee per year and will continue to do so until the debt is repaid — likely through at least 2030.

The costs to employers to support the administration and enforcement of state labor agencies have increased even more quickly. In the seven years since 2016–17, assessments for these programs have increased four-fold, and in just the past four years assessments have doubled.

The costs to employers to support the administration and enforcement of state labor agencies have increased even more quickly. In the seven years since 2016–17, assessments for these programs have increased four-fold, and in just the past four years assessments have doubled.

Of particular note is the once-obscure Subsequent Injuries Benefits Trust Fund (SIBTF) program, which provides supplemental benefits for injured workers with pre-existing conditions. Favorable court rulings and aggressive trial lawyers have pushed up spending for these benefits almost five-fold in only six years.

Agriculture and Resources

California Environmental Quality Act (CEQA)

Climate Change

Education

Energy

Environmental Regulation

Health Care

Housing and Land Use

Immigration Reform

International Trade

Labor and Employment

Legal Reform

Managing Employees

Privacy

Product Regulation

Taxation/Budget

Tourism

Transportation

Unemployment Insurance/Insurance

Water

Workers’ Compensation

Workplace Safety

Business Issues Guide

Policy Contact

Ben Golombek

Ben Golombek

Executive Vice President and Chief of Staff for Policy