Indo-Pacific Trade Relations

U.S. Works Toward Relations in Indo-Pacific; Region More Important Than Ever as China Influence Looms

• Trade with the Indo-Pacific supports almost 4 million U.S. jobs and is the source of nearly $956 billion in foreign direct investment in the United States.

• The 14 partners of the U.S.-Indo-Pacific Economic Framework (IPEF) represent 40% of global gross domestic product (GDP) and 28% of global goods and services trade.

Background

The Indo-Pacific comprises 40 countries and economies, and is the most populous, fastest-growing and most economically dynamic part of the world. By 2030, it will represent 66% of the world’s middle class, and 59% of all goods and services sold to middle class consumers will be sold in the region — which is expected to drive two-thirds of global economic growth in the years ahead.

Developing nations in the region will need about $1.5 trillion in investment every year for the next decade to develop the infrastructure necessary to sustain their growth. Despite the Indo-Pacific region’s growth, over the last decade, growth in U.S. exports has lagged. The United States is gradually losing market share in trade with Asian countries. Meanwhile, Indo-Pacific countries have signed more than 150 bilateral or regional trade agreements, while the United States has just five trade deals in the region — with Australia, Singapore, South Korea, the Philippines, and Japan.

Impact

Two-way investment and trade in the Indo-Pacific region totals roughly $2.18 trillion, supports almost 4 million jobs in the United States and more than 5 million jobs in the region as of 2023. The United States has made foreign direct investments of almost $1.07 trillion into the Indo-Pacific region in 2023. The region contains seven of the world’s 30 freest economies — Singapore, Australia, New Zealand, Taiwan, Malaysia, South Korea and Japan. The sea routes of the Indo- Pacific facilitate 50% of world trade.

Status of Free Trade Agreements in Indo-Pacific Region

• U.S.-Korea Free Trade Agreement. In 2018, President Donald J. Trump renegotiated the U.S.-Korea Free Trade Agreement (KORUS), which originally entered into force in March 2012. The renegotiated deal went into effect on January 1, 2019, and included an extension to phase out U.S. tariffs on trucks, as well as harmonized vehicle testing requirements, Korean recognition of U.S. standards on parts, and improvements to fuel economy standards. There also were modifications to Korea’s customs and verification processes, and its pharmaceutical pricing policy.

South Korea is the eighth largest export partner for both the United States and California, exporting $65.06 billion and $9.39 billion to the country, respectively.

• U.S.-Singapore Free Trade Agreement. The U.S.-Singapore Free Trade Agreement went into effect in January 2004. All tariffs have been phased out now. Singapore is a strategic partner for the United States in the Indo-Pacific region and is the 11th largest U.S. export partner. In 2023, U.S. exports totaled $42.45 billion. Singapore is California’s 12th largest export partner; state exports exceed $4.41 billion. Singapore has consistently ranked among the top countries for doing business, according to the World Bank, and is regional headquarters for hundreds of U.S. companies. As of 2024, Singapore ranked as the freest economy in the world.

• U.S.-Australia Free Trade Agreement. The U.S.-Australia Free Trade Agreement came into effect in January 2005 and eliminated tariffs on 99% of U.S.-manufactured goods exported to Australia at the time. Two-way trade between the United States and Australia was $49.51 billion in 2023. Australia is one of the United States’ oldest and closest allies due to sharing common values and major interests in each other’s economies. The United States is the largest investor in Australia.

In 2023, the United States exported $33.57 billion worth of goods to Australia, making Australia the 15th largest U.S. export partner. The United States enjoys a trade surplus with Australia that reached $14.4 billion in 2023. Australia is the 13th largest export partner for California, which exported $3.87 billion to the country in 2023.

• U.S.-Japan Limited Trade Deal. The United States and Japan have a limited trade deal, which went into effect in January 2020. The deal opened market access in Japan for certain U.S. agricultural and industrial goods. The agreement helped to give U.S. farmers and ranchers the same advantages as Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) countries selling into the Japanese market. In return, the United States reduced or eliminated tariffs on agricultural and industrial imports from Japan. A high-standard digital trade agreement also was reached separately, but concurrently, and went into effect in January 2020, as well.

In November 2021, the United States and Japan agreed to establish a new Japan-U.S. Commercial and Industrial Partnership on trade. The two countries are agreeing to collaborate more closely on trade issues, including labor, the environment, digital commerce, and confronting other countries.

Japan is the sixth largest export partner for the United States, and the fourth largest export partner of California; exports total $75.68 billion and $10.6 billion, respectively. Japan is one of the largest markets for U.S. agricultural products. The country also is the second largest investor into California through foreign-owned enterprises as of 2023.

The Japanese and U.S. markets together cover approximately 30% of global gross domestic product (GDP). The trade deal is an important step in furthering the long-shared partnership between the United States, Japan and California.

• U.S.-Taiwan Trade. The United States and Taiwan first signed a Trade and Investment Framework (TIFA) in 1994. Under the Trump administration in 2020, the U.S. showed more support for a possible trade agreement with Taiwan, relaxing some regulations to show good faith in starting talks. A trade agreement has bipartisan support and is popular among some members of the U.S. Congress. Taiwan’s September 2021 bid to join the CPTPP remains on track and has received vocal support from other CPTPP members. The move to join the CPTPP is important to the country’s long-term economic growth and stability in the region. Taiwan was notably left out of the China-led Regional Comprehensive Economic Partnership (RCEP).

In May 2024, the United States and Taiwan met for an inaugural trade meeting in Washington to continue talks on the agreed-upon U.S.-Taiwan Initiative on 21st Century Trade, meant to strengthen ties as a counter to China’s influence in the Indo-Pacific region. The talks covered proposed texts, including areas of agriculture, labor, and the environment. These talks were under the auspices of the American Institute of Taiwan and Taipei Economic and Cultural Representative Office.

Taiwan was the 13th largest export partner for the United States in 2023, with a total of $39.96 billion in goods exported to Taiwan. For California, Taiwan is the sixth largest export partner with $8.85 billion in goods being exported, including $2.9 billion in computer and electronic products.

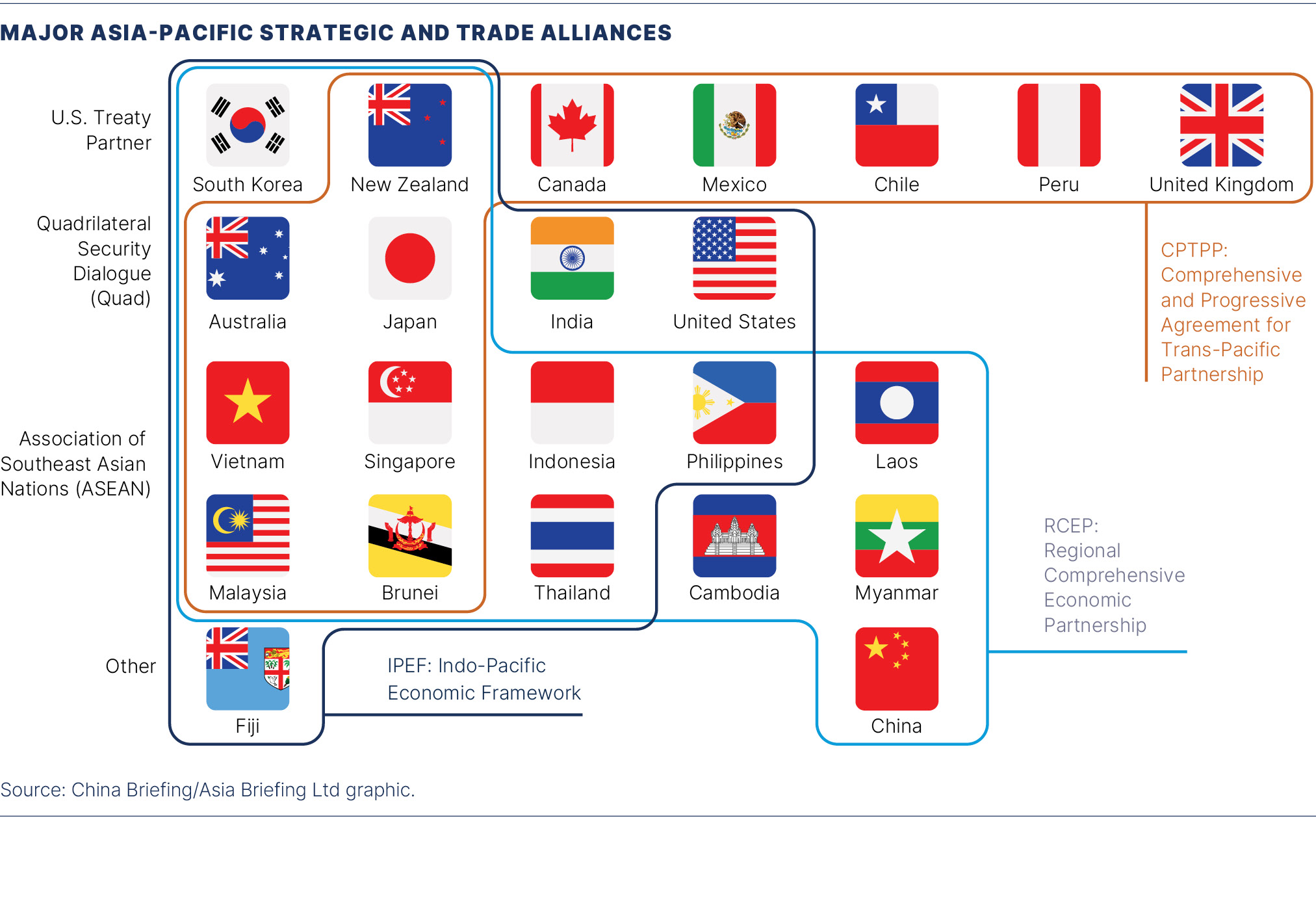

Indo-Pacific Economic Framework

In May 2022, the Biden administration launched the Indo-Pacific Economic Framework (IPEF) with Australia, Brunei Darussalam, Fiji, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Thailand, and Vietnam. The IPEF is a non-traditional trade agreement that seeks to improve trade relations by reducing “behind-the-border” trade barriers; leaves enforceability intentionally vague; and does not guarantee that the agreement won’t be voided when the new administration takes over in 2025.

The official statement states this framework is intended to advance resilience, sustainability, inclusiveness, economic growth, fairness, and competitiveness and aims to contribute to cooperation, stability, prosperity, development, and peace within the region.

Asia-Pacific Economic Cooperation

Formed in 1989, the Asia-Pacific Economic Cooperation (APEC) serves as a multilateral forum in which Asian and Pacific economies can solve economic problems and cooperate in developing key economic sectors. The United States (San Francisco) was the 2023 host for APEC. The 21 APEC economies are home to 2.9 billion people and represent approximately 60% of world GDP, and 48% of world trade as of 2018.

China, the Association of Southeast Asian Nations, and the Regional Comprehensive Economic Partnership

The tariffs in the first Trump administration were applied to a very broad range of Chinese products, such as semiconductors, steel and aluminum products, electric vehicles, batteries and battery parts, natural graphite and other critical materials, medical goods, magnets, cranes, and solar cells. The Biden administration kept most of those tariffs in place and added another $18 billion on Chinese goods (semiconductors and EVs). The Biden administration continued to use Section 301 tariffs as part of its strategy to compete more effectively with China.

Early in the campaign, President-Elect Trump suggested he would add tariffs of 60% on Chinese imports. Later he indicated he would add 10 percentage points to existing tariffs on China. There has also been discussion about revoking China’s permanent normal trade relation status (PNTR) — resulting in much higher tariffs — which would put China in the same basket as North Korea, Cuba and Belarus.

While China and the United States have a complex relationship, China’s relationship with Association of Southeast Asian Nations (ASEAN) countries continues to deepen.

The Regional Comprehensive Economic Partnership (RCEP) deal officially went into force on January 1, 2022, encompassing the 10 member nations of the ASEAN, as well as China, Japan, South Korea, Australia and New Zealand. The RCEP deal covers nearly one-third of the global population and about $25.8 trillion of global GDP, making it the largest trading bloc in the world.

The nations in ASEAN, established in 1967, have the goal of creating an ASEAN economic community (AEC) by 2025, with many participants seeing gains even with growing U.S.-China tensions. The region’s combined GDP topped $3.6 trillion in 2022. AEC already has eliminated 99% of intra-ASEAN tariffs and continues to strive for deeper economic integration. In October 2024, the Biden administration at the 12th U.S.-ASEAN Summit celebrated 47 years of U.S.-ASEAN relations. The United States noted that it has helped to spur $1.4 billion in private sector investments. ASEAN represents the world’s fourth largest market, and the United States is ASEAN’s largest source of foreign direct investment, with two-way trade exceeding $417.86 billion in 2023.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Original Trans-Pacific Partnership

The original Trans-Pacific Partnership (TPP) was signed in February 2016 and included the United States as a member. When President Trump took office in 2017, however, he pulled the United States out of the TPP. The remaining countries formed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which then came into force on December 30, 2018, for Australia, New Zealand, Canada, Japan, Mexico and Singapore, followed by Vietnam on January 14, 2019, Peru in August 2021 and Malaysia in November 2022. For the United Kingdom, the CPTPP came into force on December 15, 2024. The agreement will come into force for Brunei and Chile 60 days after they complete their ratification process.

The CPTPP retained all the tariff reductions and eliminations from the original agreement signed in 2016; however, it suspended 22 other provisions, including some intellectual property rules. The CPTPP will reduce tariffs in countries that together amount to more than 13% of the global economy — a total of $10 trillion in GDP. With the United States, the agreement would have represented 40% of the world economy. Even without the United States, the deal will span a market of nearly 500 million people, making it one of the world’s largest trade agreements.

In September 2021, China applied to join the CPTPP, preempting Taiwan’s own bid six days later. The dueling bids have created opposing sides within the trading bloc; the outcome remains to be seen. Meanwhile, South Korea also has expressed interest in the possibility of joining the CPTPP.

Anticipated Action

The California Chamber of Commerce is hopeful that the Trump administration will continue to develop relations in the Indo-Pacific region and strengthen partnerships within the region— including consideration of multilateralism rather than bilateralism.

CalChamber Position

The CalChamber supports expansion of international trade and investment, fair and equitable market access for California products abroad, and elimination of disincentives that impede the international competitiveness of California business.

The CalChamber opposes protectionist-oriented actions that will result in higher prices to the consumer for the specific product protected and limited choices of products for consumers. Protectionist measures cause a net loss of jobs in related industries, retaliation by our trading partners and violates provisions of the World Trade Organization, as well as free trade agreements.

The CalChamber seeks commercially meaningful outcomes in negotiations with regions around the world and supports, bilateral, regional, and multilateral trade agreements which are critical to consumers, workers, businesses, farmers and ranchers, and would allow the United States to compete with other countries that are negotiating agreements with each other.

The Indo-Pacific region represents nearly half of the Earth’s population, one-third of global GDP and roughly 50% of international trade. The large and growing markets of the trans-Pacific already are key destinations for U.S. manufactured goods, agricultural products, and services suppliers.

Following the U.S. withdrawal from the Trans-Pacific Partnership, a highlighted trans-Pacific relationship is welcome, as this is a key area in geopolitical, strategic, and commercial terms.

February 2025

Agriculture and Resources

California Environmental Quality Act (CEQA)

Climate Change

Education

Energy

Environmental Regulation

Health Care

Housing and Land Use

Immigration Reform

International Trade

Labor and Employment

Legal Reform

Managing Employees

Privacy

Product Regulation

Taxation/Budget

Tourism

Transportation

Unemployment Insurance/Insurance

Water

Workers’ Compensation

Workplace Safety

International Bills

- Federal Bills

- 2025-2026 Bills

- 2023-2024 Bills

- 2021-2022 Bills

- 2019-2020 Bills

- 2017-2018 Bills

- 2015-2016 Bills

Councils

Coalitions

- Alliance for Fair Trade with India

- California Coalition for Free Trade

- Federation of International Trade Associations

- North American Rebound

- Trade Works for US

- U.S. Council for International Business (USCIB)

- USA * Engage

Policy Contact

Susanne Stirling

Susanne Stirling

Senior Vice President, International Affairs