Tag: Top Stories

Cap-and-Trade Deal Also Cut Taxes

As part of a comprehensive, bipartisan solution implementing the state’s ambitious climate change goals, the legislation that extended the cap-and-trade program also included several...

Legislature Approves Cap-and-Trade Extension

With strong support from the California Chamber of Commerce and the business community, the Legislature yesterday approved AB 398 (E. Garcia; D-Coachella), which will...

Legislature to Vote Today on Extending Cap-and-Trade Program

CalChamber Issues Call to Action

The California Chamber of Commerce is urging businesses to contact their legislators to express strong support for AB 398 (E....

CalChamber Supports Legislation Extending Cap-and-Trade Program

The California Chamber of Commerce is asking legislators to approve AB 398 (E. Garcia; D-Coachella), which will extend California’s cap-and-trade program and provide the...

Future of Cap and Trade Requires 2/3 Vote Approval

The California Supreme Court recently declined to review the 2-1 split decision by the Appellate Court, which ruled that California’s current cap-and-trade auction is not a tax requiring...

Assembly Policy Committee Passes Bill Enhancing Labor Commissioner Authority

A California Chamber of Commerce-opposed bill that allows the Labor Commissioner to seek injunctive relief before completing an investigation and determining retaliation has occurred...

Nine CalChamber Members Creating Jobs with Help from Tax Credit

Nine California Chamber of Commerce member companies have been selected by the Governor’s Office of Business and Economic Development (GO-Biz) as recipients of the...

Federal Court: Current Drug Use Not Protected Under Disabilities Act

A recent federal court decision is a good reminder that applicants or employees who currently use illegal drugs or marijuana or abuse alcohol are not protected...

Can’t Find Work? Maybe You Need New Skills

By Eloy Ortiz Oakley and Allan Zaremberg in the East Bay Times

There is a troubling chasm in the world of work today and it...

Japan-California: Luncheon Underscores Longstanding Trade/Investment Partnership

An annual meeting between the California Chamber of Commerce and Japan business leaders highlighted California’s continuing interdependence with one of its largest trade and...

U.S. High Court Shuts Down Expanded State Jurisdiction

In a decision released last week, the U.S. Supreme Court has limited one potential source of unexpected litigation for companies that do business in...

It’s a Deal. Lawmakers Send Jerry Brown a Jam-Packed Budget

California lawmakers passed a spending plan for the coming fiscal year Thursday, meeting the state’s budget approval deadline with a $183.2 billion package that...

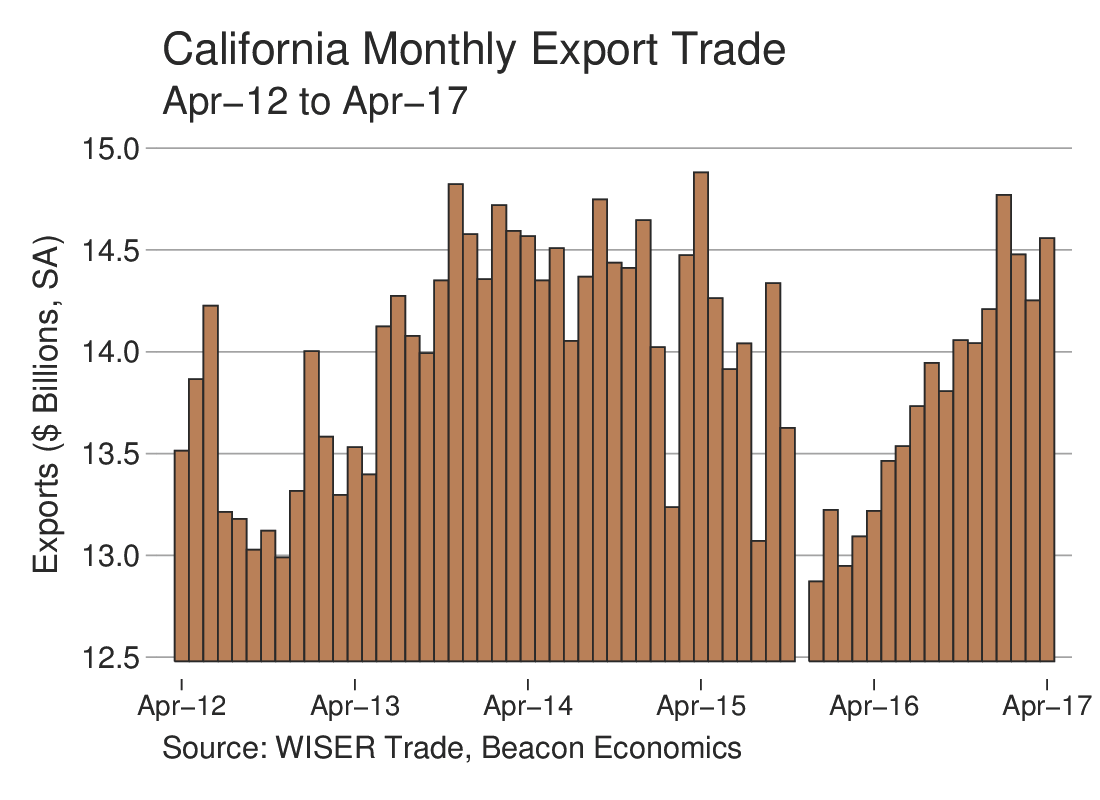

Trade Report: California Exporters Continue Strong Run

California’s exporters maintained their strong performance in 2017 by posting impressive gains in April, according to a recent Beacon Economics trade report.

According to Beacon...

Disruption in Washington, D.C. Heightens Economic Uncertainty in California

The California economy remains on track despite the uncertainty created by the disruptive political environment that has characterized the early months of the Trump...

2017 Board Chair: CalChamber Membership Helps Businesses Thrive

A California Chamber of Commerce video featuring 2017 Board Chair Susan Corrales-Diaz was released last week at the 92nd Annual Sacramento Host Breakfast. The...

CalChamber Urges Members to Write in Support of Modernizing NAFTA

The California Chamber of Commerce is urging members to send a letter to the Federal Register Notice (FRN) by Monday, June 12 supporting the...

International Forum: State, U.S. Economies Depend on Strong Trade Opportunities

The importance of trade and the ability of U.S. and California companies to compete more effectively in foreign markets was the topic discussed by...

Governor Brown, CalChamber Chair Offer Ways to Keep California on Forefront of Innovation

The importance of international trade, immigration reform and technology to California were the subjects of a speech given by California Chamber of Commerce Board...

CalChamber Chairwoman Says Retaining Foreign Students is Critical for State

The chairwoman of the California Chamber of Commerce said the state’s ability to remain at the forefront of technology depends on improving technology education...

Californians Rely on Our Judiciary to Ensure and Protect Access to Justice

“Separation of powers,” “judicial independence” and “rule of law” are abstract concepts with important implications. At an abstract level, most Americans cannot identify with...