The enduring lesson for policy makers as California recovers from the Pandemic Era should be restraint. California enjoys a bountiful budget surplus, but nobody should fool themselves that it lasts forever.

The enduring lesson for policy makers as California recovers from the Pandemic Era should be restraint. California enjoys a bountiful budget surplus, but nobody should fool themselves that it lasts forever.

Often through no fault of their own, elected leaders and government officials missed or misinterpreted the trends since 2020 that should normally inform wise public policy. Unpredictability became the regular order of business:

- Not only did the Covid-19 pandemic take the world by surprise and mostly unprepared, but subsequent virus variants have also shaken our ability to plan for the future and drive a consensus on how to return to even a new normal.

- The California state budget boomeranged from predictions of deep deficits to unforeseen record surpluses.

- The pandemic collapsed the world’s supply chains, hampering economic recovery and contributing to a rapid rise in inflation.

- Labor markets have transformed before our eyes. A record 4.5 million workers quit their jobs in November, and employers are scrambling to fill well-paid jobs as unemployment rates continue to fall.

- Nevertheless, more Californians simply weren’t interested in working. The labor force participation rate in California was at 61.9 percent in November 2021, still 1.2 percentage points below the level just before the pandemic started.

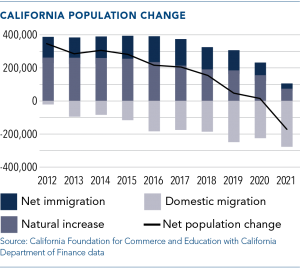

- California’s population has continued to decline after falling for the first time on record, new demographic data show — underscoring shifting immigration and migration patterns, declining birthrates and the large number of deaths at the hands of the pandemic.

Governor Newsom paid his respects to uncertainty when he released his proposed budget for the 2022-23 fiscal year. Faced with a second consecutive year of budget surpluses, he allocated 86% of the projected $46 billion surplus not dedicated to schools to one-time investments, such as debt repayment, retirement system liabilities, infrastructure, and tax relief. These policy choices contrast with the preferences in past decades to spend nonrecurring capital gains windfalls on ongoing (programs or entitlements, ratcheting up state budgets using unsustainable revenues. When the inevitable business cycle turned, as it has in recent recessions, elected leaders faced the unhappy scenario of cutting popular programs, raising taxes, or engaging in borrowing or budget tricks.

The remaining political risk to the California economy and jobs climate lies with a legislative agenda that often sets aside the lessons of uncertainty. Or put another way, many legislators behaving as if it was business-as-usual.

California’s economy is massive, diverse and resilient. That’s why the state treasury is overflowing with revenues. California employers, entrepreneurs and small businesses found a way in the teeth of the pandemic, intense international competition and pernicious state regulations and mandates to grow their businesses, profits and tax payments.

But signs of weakness continue to manifest, most troublingly the continuing exodus of middle-class workers to other states, without the foreign immigration to cushion that exodus.

Last year, with continuing fertility declines and increased deaths from aging and the pandemic, California actually lost population. But most significantly, since 2011, California has suffered net domestic outmigration, and since 2015, this domestic outmigration has exceeded international migration. While net international migration added population since 2015, negative domestic net migration overwhelmed these gains, resulting in an overall net migration loss of nearly 600,000 residents.

Last year, with continuing fertility declines and increased deaths from aging and the pandemic, California actually lost population. But most significantly, since 2011, California has suffered net domestic outmigration, and since 2015, this domestic outmigration has exceeded international migration. While net international migration added population since 2015, negative domestic net migration overwhelmed these gains, resulting in an overall net migration loss of nearly 600,000 residents.

Which brings us back to public policy. With middle class and working Californians already anxious about crime, homelessness and affordability, the Legislature should think twice about their increasingly ambitious plans to remake California’s economy and social contract. Instead, elected leaders should:

- Quash the recently-revived single payer health care proposal, which would upend every public and private health care relationship into a massive new state bureaucracy, with a price tag of more than $150 billion annually in new taxes – mostly on businesses.

- Shelve expensive new mandates for employer-provided benefits, that add costs onto employers and expose them unnecessarily to litigation. The State for the second consecutive year enjoys a record budget surplus that could pay for many of the benefits that legislative proposals have attempted to impose on businesses, such as subsidized child care, extended paid leave of absences with little accountability, and onerous and constantly changing workplace mandates that at times conflict with other government guidance.

- Maintain exemptions in state privacy legislation that prevent employees from using consumer privacy rights to remove adverse information in their personnel files (like sexual harassment incidents). The exemptions also permit business-to-business relationships from being constrained by consumer privacy requirements.

- Throttle back the headlong race to adopt more aggressive greenhouse gas regulations and clean energy mandates and resist the urge to choose technological winners and losers. The price for these good intentions is higher utility bills and prices at the fuel pump. Return to the earlier consensus to use market forces to discover the most cost-effective path through a changing climate.

- With California’s nation-leading poverty rate driven by the cost of shelter, and residents bolting to other states to afford homeownership, elected leaders should reject any proposal that would increase the price or reduce the supply of housing.

California retains significant competitive advantages as a place to create or grow a business. Employers, alongside many elected and community leaders, toil diligently to make California home for their enterprises. But the uncertainty of the new, post-pandemic normal demands policy makers take even more care to not disrupt recovery with thoughtless and burdensome legislation and regulations.

Contact: Loren Kaye