The Economy Is Powering Ahead

Overview

The recession is officially over. It ended more than a year ago, but it takes time for the group of economists at the National Bureau of Economic Research, the organization that determines peaks and troughs of a business cycle, to wait for all the revised economic data to formally determine the start and end of recessions.

The recession is officially over. It ended more than a year ago, but it takes time for the group of economists at the National Bureau of Economic Research, the organization that determines peaks and troughs of a business cycle, to wait for all the revised economic data to formally determine the start and end of recessions.

| Download Report PDF | Past Reports |

This recent recession ended last April. It was the shortest recession and deepest recession in the post-World War II period.

But that was then, and this is now. The economy is growing on most cylinders. It rose 6.5% in Q2. In Q3, growth is expected to be slightly more robust, with the Bloomberg economic consensus estimate around 7.0%. If that plays out, it will be the strongest quarterly growth rate of this year and the most robust rate of growth going back to 2000, outside of last year’s Q3 reopening.

With the continued growth since the reopening, economic output has surpassed the previous peak, which moves this economy from the recovery phase to the expansion phase. The economy now stands 0.8% stronger than it did before the pandemic set in. Based upon the Fed’s projection of gross domestic product (GDP) growth, the economic output should be above the previous trend growth rate by the end of Q4.

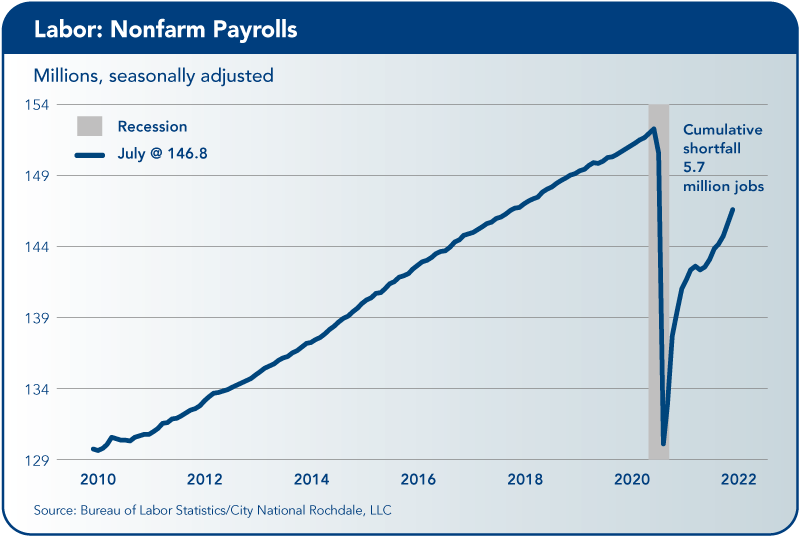

Unfortunately, the labor market has yet to recover fully. The employment deficit stands at 5.7 million below the February 2020 peak of 152.5 million (3.7% below that peak). But the employment recovery is well underway. There are 10.1 million job openings, which is the highest level on record with data going back to 2000. In addition, 9.5 million people are looking for jobs, which means there are 1.1 job openings for every job seeker.

Gross Domestic Product

Capacity Constraints Put a Cap on Growth

The economy grew 6.5% in Q2. Although slower than expected (forecast 8.5%), the gentler growth rate was due to the lack of supply, not demand. The decline in inventories alone took away 1.1 percentage points. As the economy works through bottlenecks, the supply will meet the demand, keeping economic growth strong.

Still, at 6.5%, we are talking about a breakneck pace, more than three times the economy’s pace averaged during the past expansion. Moreover, demand is expected to stay strong due in part to the high level of savings. Although the saving rate is off its recent unsustainable highs, it is still well above the average for the past few decades.

Consumer spending is the driving force behind the high Q2 GDP. There was a torrid pace of spending in Q2. It was up 11.8%, which was on top of Q1’s eye-popping gain of 11.4%. Outside of the craziness of last year’s closing and opening, these have been impressive gains in the first two quarters of this year, about three times greater than the long-term average of 3.3%. The $2.5 trillion in extra household savings has been burning holes in consumers’ pockets.

Most state and local governments have ended COVID-19 restrictions, and shoppers went out and spent money. As expected, there is starting to be a pivot in consumer spending away from goods and toward services. Sales of sectors that benefited from staying at home (furniture, sporting goods, and building materials) declined. In contrast, sales at restaurants, bars, and stores that sell clothing accessories all benefit from shoppers being able to return to the stores en masse.

The sales of vehicles fell for the third straight month. They are being strangled due to a lack of inventories because of supply chain problems with semiconductors. This significantly impacts retail sales since vehicle sales account for more than one-fifth of total sales.

Households are still benefiting from the generosity of the federal government’s stimulus checks. However, as that fades over the coming months (last year’s checks took about six months), it will be partially offset by some households benefiting from the child tax credits (about $15 billion per month). As the economy works its way through the bumpy recovery, fortunately, household spending has not been, and will not be, one of the problems.

Labor

Strong Labor Gains Expected to Continue

Employment growth should be strong over the coming months, as the economy opens up, and there will be the complete termination of the expanded unemployment benefits. These factors will pressure potential workers to accept job offers that may not have been viewed as appealing when they could collect an unemployment check.

The strengthening trend in the three-month moving average is expected to continue despite economic growth peaking. This is because employment gains always lag economic growth.

Inflation

Inflation May Have Peaked, But Will Not Fall Quickly

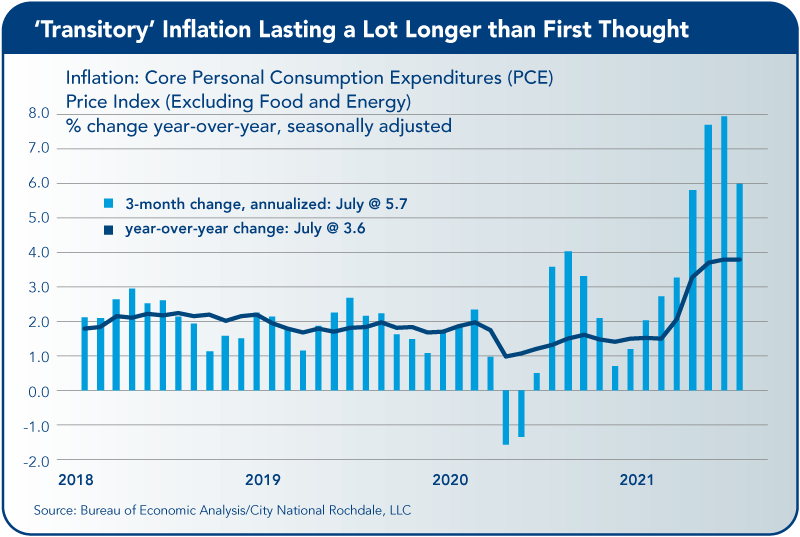

The reopening of the economy and the high number of vaccinations have caused a surge in demand for goods and services to record heights, pushing economic output up when the supplies of goods and services have not been able to keep up, lifting prices.

This quarter looks like the apex of this cycle. GDP and inflation appear to be peaking in Q3. That said, economic growth and inflation should continue to run at a robust pace well into next year.

Spending has been the fun side of the normalization of the economy, but higher inflation has caused misery. Some of the high inflation is due to the comparison to the meager prices during the lockdown (base effect).

For example, oil in the past year is up 87%, but compared to two years ago, it is up just 26%, and compared to three years ago, it is down 1%.

So, how bad is this inflation? Other parts of the high inflation are due to shortages; this is most notable in automobiles. The shortage of semiconductors has restricted the number of new vehicles being produced and sold, pushing up demand and prices of used cars, up 42% in the past year. This has helped push up the transportation component of inflation, which is the driving force behind the high inflation rate.

We view the unprecedented levels of fiscal stimulus as the catalyst for the burst in inflation. It will lessen over the coming months. Eventually, the economy will return to the one it was before the pandemic, and consumers will again be price-sensitive. The base effect will age away, and production is being ramped up to meet the demand for those products in short supply.

The streak of outsized inflation gains is probably over. The July monthly gain was 0.5%; the previous three months averaged 0.8%. Although this is good news, the return to pre-pandemic inflation levels remains in the distant future — the higher transient prices will be with us longer than previously thought.

This belief has been substantiated in recent weeks with many corporate announcements suggesting that supply chain normalization may not be complete until late next year.

Federal Reserve

Still on Hold

The outlook is improving enough that the Fed is contemplating removing some of the massive amounts of stimulus they provide the economy. They are not ready to move yet, but they are talking about it.

The first step will be to reduce their bond-buying program, which used to be called quantitative easing. Currently, they are buying $120 billion each month ($80 billion in treasuries and $40 billion in mortgages).

City National Rochdale believes the Fed will wait until year-end or 2022 before they begin tapering those bond purchases.

The second step in reducing stimulus is much further down the road. It will be the raising of short-term interest rates. However, that will probably not happen until the Fed has finished tapering their bond-buying program, which would be the end of 2022 or 2023.

Pandemic

Rise in COVID Cases Gives Jitters to Financial Markets

The number of cases of the Delta variant has surged, reversing the optimistic tone that the market had embraced since cases started to decline at the beginning of January. The average daily case count stood at 150,000 on September 3, up from the low point of 12,000 in June.

The risk in the United States appears to be manageable since hospitalizations and death rates are well below the previous peak. However, the risk to the global economy, especially where vaccination rates are much lower, is a growing concern.

City National Rochdale View

Despite mixed data over the past few weeks, the economy continues to thrive. What is happening with the economy is simple: Demand is strong, and supply is struggling to keep up. The imbalance, of course, is continuing to have an impact on prices.

As a result, the “transitory price pressures” are no longer predicted to last just a few months but now at least six months to maybe a year. But payroll gains are expected to continue at a robust pace and economic growth will grow above the long-term trend rate for some time.

Staff Contact: Dave Kilby

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior portfolio manager, City National Rochdale.