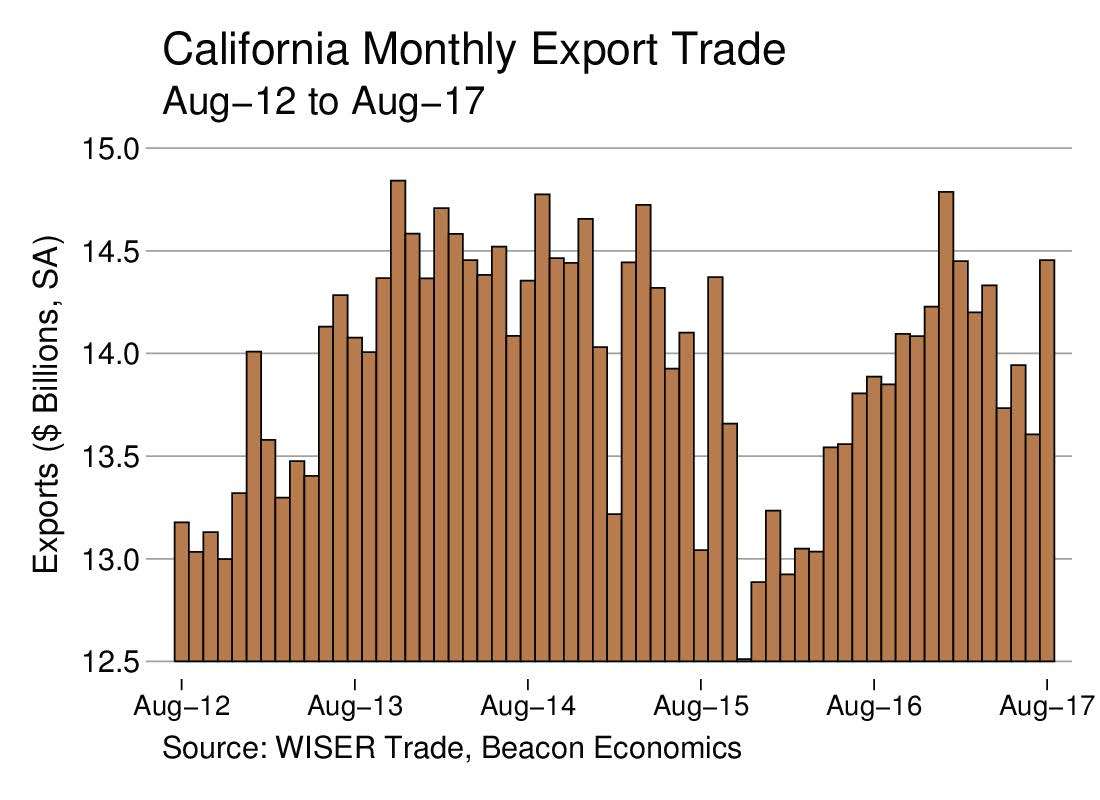

California’s export trade grew in September, according to a Beacon Economics analysis of U.S. trade statistics released November 3 by the U.S. Census Bureau.

Foreign shipments by California businesses totaled $14.19 billion for the month, a nominal 4.0% increase over the $13.65 billion recorded in September 2016.

The state’s exports of manufactured goods in September rose 7.5% to $8.79 billion from $8.18 billion one year earlier. Exports of nonmanufactured goods (chiefly agricultural products and raw materials) climbed by 8.3% to $1.82 billion from $1.68 billion. Re-exports, meanwhile, slipped by 5.5% to $3.58 billion from $3.79 billion.

September’s export growth was mirrored in a 7.1% increase in airborne export tonnage at Los Angeles International Airport, the state’s leading aviation gateway. Airborne shipments typically account for approximately half of the state’s merchandise export trade by dollar value.

California accounted for 10.9% of the nation’s overall merchandise export trade in September. Through the first nine months of 2017, the state’s exports are running 5.5% ahead of last year.

California Imports Rise

The U.S. Department of Commerce determined that California was the state-of-destination for 18.6% of all U.S. merchandise imports in September, with a value of $37.39 billion, 4.6% higher than the $35.76 billion in imported goods in September 2016. Manufactured imports totaled $33.92 billion, up 3.7% from $32.72 billion last year. Nonmanufactured imports in September were valued at $3.47 billion, fully 14.1% higher than the $3.04 billion recorded one year earlier.

Closer Look

As always, Beacon Economics cautions against reading too much into month-to-month fluctuations in state export statistics, especially when focusing on specific commodities or destinations. Significant variations can occur as the result of unusual developments or exceptional one-off trades and may not be indicative of underlying trends.

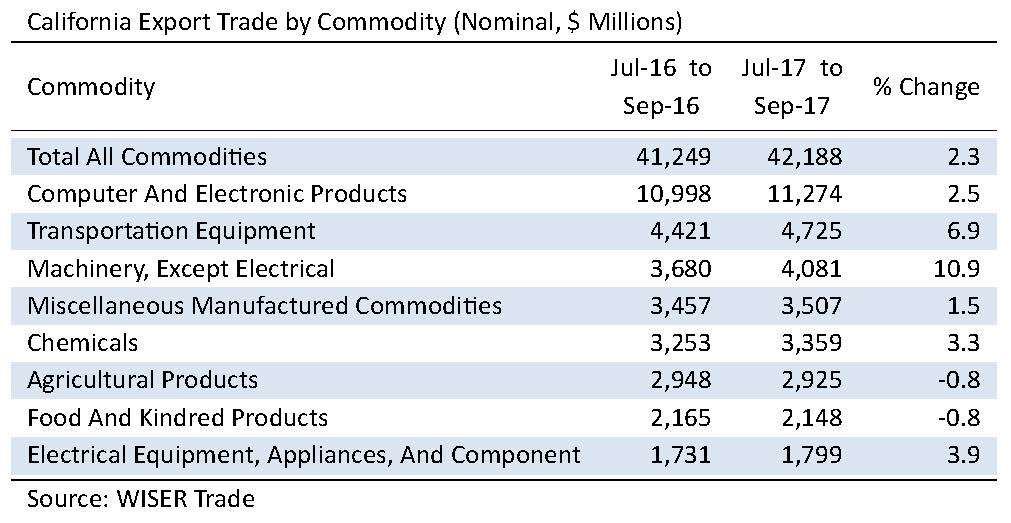

For that reason, Beacon Economics compares the latest three months for which data are available (i.e., July–September) with the corresponding period one year earlier.

Leading Export Commodities

California’s merchandise exports during the year’s third quarter totaled $42.19 billion, a nominal gain of 2.3% from the $41.25 billion in the same period last year. Of the state’s 10 leading categories of exports, eight saw increases.

The plus-side list was topped by shipments of Computer & Electronic Products (computers and peripherals; communication, audio, and video equipment; navigational controls; and electro-medical instruments), which rose 2.5% to $11.27 billion from $11 billion. The state’s exports of Transportation Equipment (automobiles, trucks, trains, boats, airplanes, and their parts) fared even better, increasing by 6.9% to $4.73 billion from $4.42 billion.

Exports of Non-Electrical Machinery (machinery for industrial, agricultural and construction uses as well as ventilation, heating, and air conditioning equipment) roared ahead by 10.9% to $4.08 billion from $3.68 billion. Shipments of Miscellaneous Manufactured Commodities (a catchall category of merchandise ranging from medical equipment to sporting goods) nudged up 1.5% to $3.51 billion from $3.46 billion.

Chemical exports (including pesticides and fertilizers; pharmaceutical products; paints and adhesives; soap and cleaning products; and raw plastics, resins, and rubber) were up 3.3% to $3.36 billion from $3.25 billion. Exports of Electrical Equipment and Appliances increased 3.9% to $1.80 billion from $1.73 billion. Exports of Fabricated Metal Products rose 4.4% to $1.09 billion from $1.04 billion.

On the downslope, Agricultural exports slipped 0.8% to $2.93 billion from $2.95 billion, while shipments abroad of Food & Kindred also declined by 0.8% to $2.15 billion from $2.16 billion.

Exports of Primary Metal Manufacturing products tumbled by 57.4%, falling to $758 million from $1.78 billion. Joining the billion dollar a quarter club was Waste & Scrap exports, which jumped 23.4% to 1.05 billion from $852 billion one year ago.

Destinations

Mexico remained California’s most important export destinations during the latest quarter. Shipments south of the border grew by 2.8% to $6.70 billion from $6.52 billion. Canada placed second with exports north of the border increasing by 2.9% to $4.25 billion from $4.13 billion. Exports to China jumped 9.0% to $3.95 billion from $3.62 billion. In fourth place was Japan, which saw its import trade from California expand by 5.4% to $3.04 billion from $2.88 billion. Hong Kong, up 10.6% to $2.75 billion from $2.49 billion, rounded out the Top Five Export Destinations list.

Due mainly to a massive year-over-year fall-off in exports to Vietnam, the state’s export trade with the economies of East Asia expanded by just 0.8% to $15.38 billion from $15.26 billion. By comparison, California’s exports to the European Union rose 9% to $7.92 billion from $7.27 billion.

Mexico and Canada, America’s partners in the North American Free Trade Agreement, accounted for 26% of California’s merchandise export trade in the latest three-month period, up from 25.8% one year ago.

Mode of Transport

During the most recent three months, 49.4% of the state’s $42.19 billion merchandise export trade went by air, while waterborne transport carried 27.7% of the outbound trade. The balance of exports traveled overland to Canada and Mexico.

The Outlook

Beacon Economics estimation of the near-term outlook for California exporters remains positive, although they do remain troubled by the longer-term impact of pending shifts in the direction of U.S. trade policy.

One definite concern is the future of the North American Free Trade Agreement (NAFTA). With Mexico and Canada accounting for just over one-fourth of California’s merchandise exports, the pact’s renegotiation process is disconcerting as is the lack of progress on resolving key disputes.

Staff Contact: Susanne T. Stirling