California cities continue to rank among the most expensive in the country to do business, and it is unlikely that California will relinquish its status as a “high cost” state anytime soon, according to the 2015/2016 Kosmont-Rose Cost of Doing Business Survey.

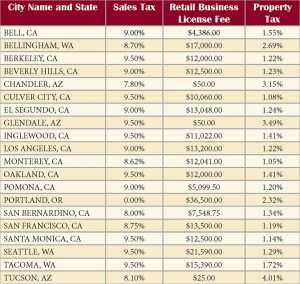

The 20 most expensive cities are located in four states—Arizona, California, Oregon and Washington.

California dominates the list with 13 cities—nine in Southern California and four in Northern California, with three of those being in the San Francisco Bay Area.

This is the 21st annual Kosmont-Rose Institute Cost of Doing Business Survey. The Rose Institute gathered data on municipal and county taxes, fees, and demographics from 305 selected cities in the Western United States. The survey takes a close look at the cost of doing business in California and eight other states that companies might consider as alternatives to California (Arizona, Colorado, Nevada, New Mexico, Oregon, Texas, Utah, and Washington).

The 20 most expensive cities in the West include several of the largest cities in the region. Seven of the 10 largest western metropolitan areas are represented on the list: Los Angeles, Portland, San Francisco, Santa Monica, Bellingham, Glendale, Culver City, Berkeley, Inglewood, Oakland. Many of the most expensive cities are important regional hubs.

According to the survey, in spite of high taxes and fees, these cities often are attractive to business because they provide access to financial markets, concentrated manufacturing and distribution, and regional and international trade. Many businesses are willing to pay a premium in business, property, and utility taxes in order to benefit from the abundance of business opportunities available in such cities.

On the opposite side of the spectrum, two California cities, Brea and Lake Forest in Southern California, made the list for the least expensive cities to do business.

The 2015 survey’s findings indicate that the Bay Area and Los Angeles are the two most expensive metropolitan areas in the western United States, followed by Portland. The three most expensive cities in the Bay Area are San Francisco, Berkeley and Oakland.

All three cities have high utility rates of 7.5%. San Francisco ranks first on the list with an extremely high business license fee for a medium-sized retail business (typically a store of roughly 5,000 to 15,000 square feet with approximately 25 to 75 full-time equivalent employees) of $60,000 a year. Seven of the 20 most expensive cities are in Los Angeles County: Los Angeles, Santa Monica, Culver City, Inglewood, Beverly Hills, Bell, and El Segundo. In these cities, a medium-sized retail business would pay between $4,386 and $52,800 a year in business license fees.

The survey found that utility user taxes are an important determinant of business expense. Not surprisingly, many of the 20 most expensive western cities have high utility tax rates. While only about half of all cities in the survey have utility user taxes, 15 of the 20 most expensive cities have utility user taxes above 5%, and five have at least one utility tax at or above 10%.

In Arizona, the state and county privilege (sales) tax also is assessed on utilities, which helps explain Arizona’s very high utility taxes. California has no equivalent tax on utilities. Los Angeles and Culver City have the highest electricity tax rates in the survey at 12.5% and 11%. Glendale (CA) and Culver City have the highest telephone tax rates at 12.7% and 11%. Beverly Hills is the only city on the list that does not have taxes for electricity and telephone services.

Many of the 20 most expensive western cities also have very high property tax rates. Five cities have property tax rates above 2.3%, nearly double the survey’s median property tax rate. Tucson has the highest property tax rate in the list at 4.01%, followed by Glendale (AZ) at 3.49% and Phoenix at 3.24%. California’s Proposition 13 greatly limits property tax rates; the 13 California cities on the most expensive cities list have property tax rates ranging from 1.05% to 1.55%.

Many, though not all, of the most expensive western cities also have high business license taxes. These taxes vary widely. A medium-sized retail business would pay $60,000 per year in San Francisco, $52,800 in Los Angeles, and $41,490 in Seattle. In 13 of the 20 most expensive cities, a medium-sized retail business would pay more than $10,000 a year — compared to an overall median business license fee of $1,025 in the survey.

California a High Cost State: Going Higher in 2017

The November 2016 election included 427 local tax and bond measures in California, of which 343 passed, an 80% pass rate. Final counts may slightly change approval results but the trend is inescapable; costs are going up in most cities and counties in California, now the fifth largest economy in the world. In total, 2016 election results represent a 56% increase in the number of approved tax measures from the prior election in 2014, the survey found.

Leading the charge on new taxes are 50 approved measures to increase local sales tax rates, 37 approved measures to impose local taxes on marijuana, 22 approved measures to increase or extend parcel taxes, 15 approved measures to increase sales tax for special purposes (mostly for transportation), and 12 measures to increase transient occupancy (hotel) taxes. In addition, three measures taxing sugared beverages were approved—in Albany, San Francisco and Oakland.

More Information

To view the survey’s executive summary, visit www.RoseInstitute.org.