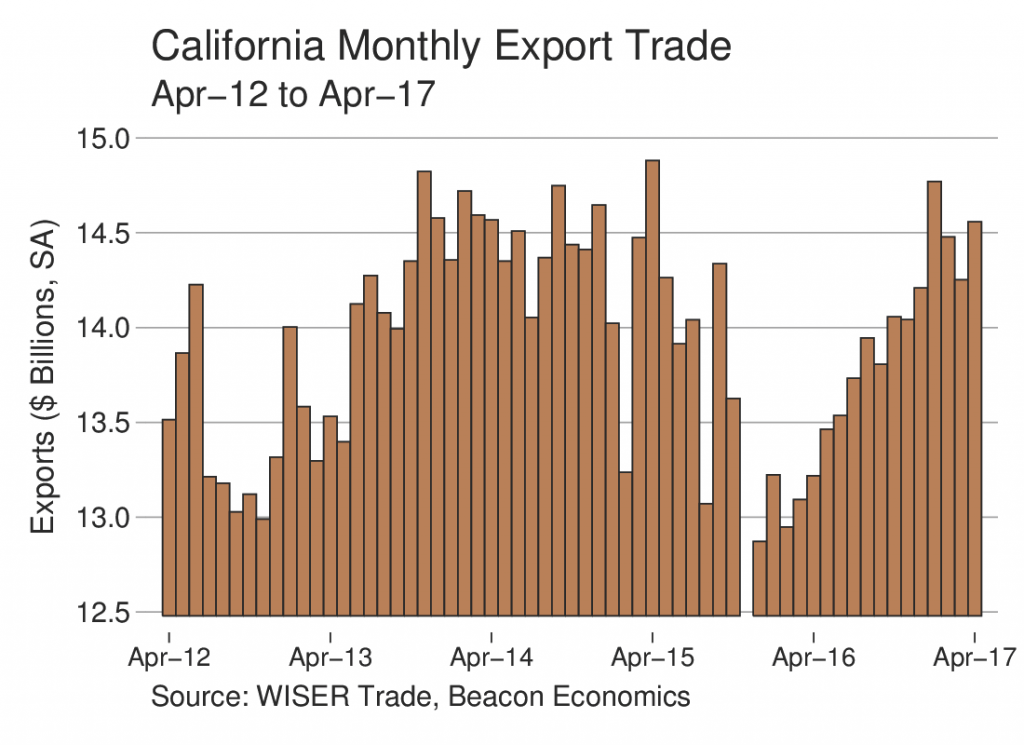

California’s exporters maintained their strong performance in 2017 by posting impressive gains in April, according to a recent Beacon Economics trade report.

According to Beacon Economics’ analysis of U.S. trade statistics released June 5, foreign shipments by California businesses totaled $14.07 billion for the month, a 9.6% increase over the $12.84 billion recorded in April 2016. Through the first four months of 2017, the state’s export trade is running 9.9% ahead of last year.

The state’s exports of manufactured goods in April rose by 8.2% to $9.12 billion from $8.43 billion one year earlier. Exports of non-manufactured goods (chiefly agricultural products and raw materials) jumped by 17.9% to $1.69 billion from $1.43 billion. Re-exports, meanwhile, grew by 9.6% to $3.26 billion from $2.97 billion.

By way of comparison, the nominal value of overall U.S. merchandise exports in April moved up by 6.3%.

California accounted for 11.1 % of the nation’s overall merchandise export trade. The gains were reflected in the increased volume of outbound traffic at the state’s principal international trade gateways. Airborne export tonnage from LAX and SFO was up 13.3% from last April, while the number of outbound loaded containers sailing from the Ports of Los Angeles, Long Beach, and Oakland rose by 4.8% over April 2016.

California Imports Rise

The U.S. Department of Commerce has determined that California was the state-of-destination for 18.2% of all U.S. merchandise imports in April, with a value of $34.71 billion, 10.8% higher than the $31.33 billion in imported goods in April 2016. Manufactured imports totaled $31.03 billion, up 8.7% from $28.55 billion last year. Non-manufactured imports in April were valued at $3.68 billion, fully 32.6% higher than the $2.78 billion recorded one year earlier.

A Closer Look At The Numbers

As always, Beacon Economics cautions against reading too much into month-to-month fluctuations in state export statistics, especially when focusing on specific commodities or destinations. Significant variations can occur as the result of unusual developments or exceptional one-off trades and may not be indicative of underlying trends. For that reason, Beacon Economics compares the latest three months for which data are available (i.e., February-April) with the corresponding period one year earlier.

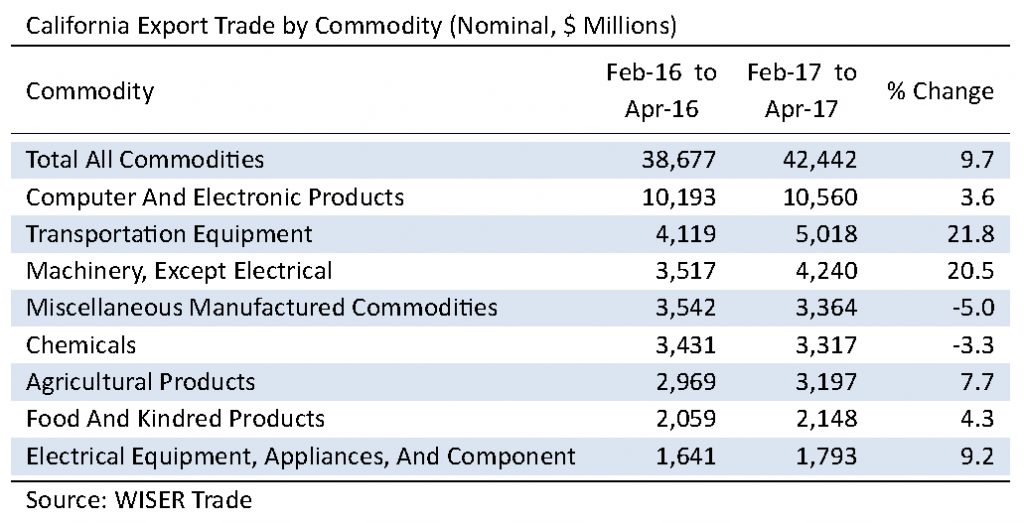

California’s merchandise exports during the latest three-month period totaled $42.44 billion, a nominal gain of 9.7% from the $38.68 billion in the same months last year.

Eight of the 10 leading categories of exports saw increases. On the plus side, the list was topped by shipments of Computer & Electronic Products (computers and peripherals; communication, audio, and video equipment; navigational controls; and electro-medical instruments), which grew by 3.6% to $10.56 billion from $10.19 billion.

The state’s exports of Transportation Equipment (automobiles, trucks, trains, boats, airplanes, and their parts) leapt by 21.8% to $5.02 billion from $4.12 billion. Exports of Non-Electrical Machinery (machinery for industrial, agricultural and construction uses as well as ventilation, heating, and air conditioning equipment) likewise soared by 20.5% to $4.24 billion from $3.52 billion.

Agricultural exports were up 7.7% to $3.20 billion from $2.97 billion, while foreign shipments of Food & Kindred goods rose 4.3% to $2.15 billion from $2.06 billion.

Exports of Electrical Equipment and Appliances nudged up 9.2% to $1.79 billion from $1.64 billion, while exports of Primary Metal Manufacturing products jumped 145.1% to $1.64 billion from $683 million. Exports of Fabricated Metal Products rose by 6.5% to $1.07 billion from $1.01 billion. Exports of Petroleum and Coal Products were valued at $981 million, up 19.9% from $819 million in the same period one year earlier.

Trending lower were exports of Miscellaneous Manufactured Commodities (a catchall category of merchandise ranging from medical equipment to sporting goods), which slipped lower by 5.0% to $3.36 billion from $3.54 billion. Chemical exports (including pesticides and fertilizers; pharmaceutical products; paints and adhesives; soap and cleaning products; and raw plastics, resins, and rubber) also declined, falling 3.3% to $3.32 billion from $3.43 billion.

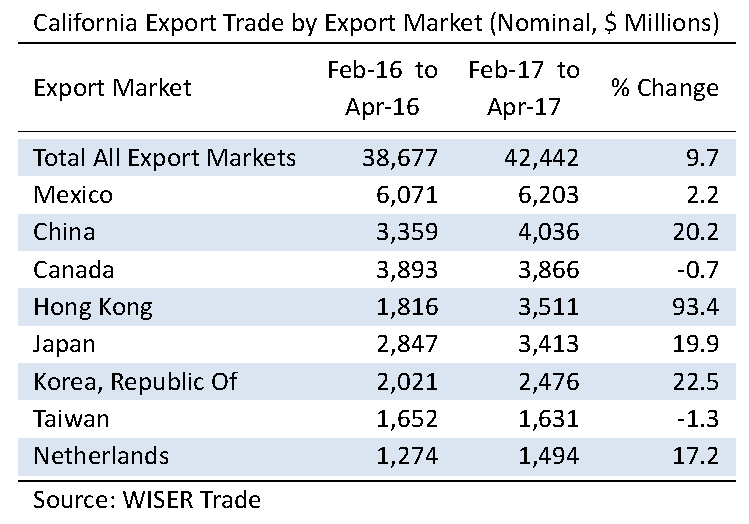

Mexico remained California’s most important export destination during the last three months, despite anxieties over the future of the North American Free Trade Agreement (NAFTA). Shipments south of the border edged up 2.2% to $6.20 billion from $6.07 billion. Exports to China jumped 20.2% to $4.04 billion from $3.59 billion. In third place was Canada, which took in $3.87 billion in California exports, off 0.7% from $3.89 billion last year. In fourth place was Hong Kong, which saw its imports from California soar by 93.4% to $3.51 billion from $1.87 billion. Japan ranked fifth, importing $3.41 billion in goods from California, up by 19.9% from $2.85 billion a year earlier. South Korea, up 22.5% to $2.48 billion from $2.03 billion, rounded out the list of foreign markets importing at least $2 billion in merchandise from California during the last three months.

The state’s export trade with the economies of East Asia leapt by 25.1% to $16.63 billion from $13.30 billion. By comparison, California’s exports to the European Union moved up by 7.0% to $7.97 billion from $7.45 billion. Mexico and Canada, America’s partners in NAFTA, accounted for 23.7% of California’s merchandise export trade in the latest three-month period. Exports to our two neighbors nudged up a combined 1.1% to $10.07 billion from $9.86 billion one year earlier.

By mode of transport, 49.7% of the state’s $42.44 billion merchandise export trade during the most recent three months went by air, while waterborne transport carried 28.4% of the outbound trade. The balance traveled overland to Canada and Mexico.

The Outlook

The economic outlook abroad continues to look favorable for California exporters. China’s economy is expanding, and growth prospects in much of Europe are improving. And, although the process of renegotiating the terms of NAFTA are formally underway, there appears little reason to expect that U.S. trade with Mexico and Canada will be disrupted, at least in the short-term.

According to Beacon Economics experts, for California and other states whose industries are closely linked to the economies of the Far East, the main concern right now lies with the security threat posed by North Korea and the danger it presents to trans-Pacific trade.

Staff Contact: Susanne T. Stirling