Return Drivers in S&P 500

Return Drivers in S&P 500

AI excitement has affected performance and valuation. The 7 Tech Titans have produced an average return of 88% in 2023 as investors chase the AI theme. In contrast, the remaining Standard & Poor’s (S&P) 493 stocks have produced a modified market cap-weighted return of only 1%.

The 7 Tech Titans trade at an average next 12-month price-to-earnings (P/E) multiple of 32.0x, which represents a large premium to the median P/E multiple of 16.3x for the S&P 493. For context, the S&P 500 traded at a median P/E multiple of 15.4x over the past 15 years’ returns.

10-Year Treasury Yields Rise Fast, Spooking Markets

The seven-year yield rose 0.64% during the 3rd quarter, while the 10-year and 30-year yields both rose by more than 0.75%. The sharp rise in yields was a big development during the quarter. Excluding the pandemic, the last two times the 10-year yield rose by more than 0.75% in a three-month period were in 2013 and 2016.

One contributing factor was the surge in oil prices and subsequent increase in inflation. While the economy remained stronger than expected and oil prices rose, there is a growing realization that the Federal Reserve may need to keep interest rates higher for longer to prevent inflation from becoming entrenched.

Another contributing factor was the increased issuance of Treasury bonds. Treasury bond issuance is forecast to increase in the coming quarters, and investors are concerned that the surge in supply will outpace investor demand and cause bond prices to decline.

Higher Borrowing Costs Affecting Consumers, Businesses

The rise in borrowing costs represents a significant change from the past decade, when interest rates were much lower. New borrowers face higher monthly payments, which changes the math behind how much they can afford.

Businesses are paying higher interest rates on corporate bonds and loans. The rise in rates also will be difficult for borrowers with variable interest rate loans, which fluctuate based on an underlying benchmark or index. Those borrowers took out loans with a lower initial interest rate but are now paying significantly more interest.

Auto Loan Delinquencies Rising

The percentage of auto loan delinquencies, which is defined as loans 90 days or more overdue, is rising across every age group. In the 18–29 and 30–39 age groups, the percentage of delinquent loans is approaching levels from the 2008 financial crisis.

In addition to auto loans, there is a similar trend in the number of credit card delinquencies, as well as an increasing number of Chapter 11 business bankruptcy filings.

The U.S. consumer, which accounts for approximately two-thirds of total U.S. economic activity, boosted economic growth coming out of the pandemic. A tight labor market kept unemployment low and boosted wages, and consumers showed an unwavering desire to spend.

However, the rising number of delinquencies indicates that consumers are struggling to keep up with their loan payments. Savings from the pandemic are shrinking, and student loan borrowers will face the added pressure of loan repayments starting this fall.

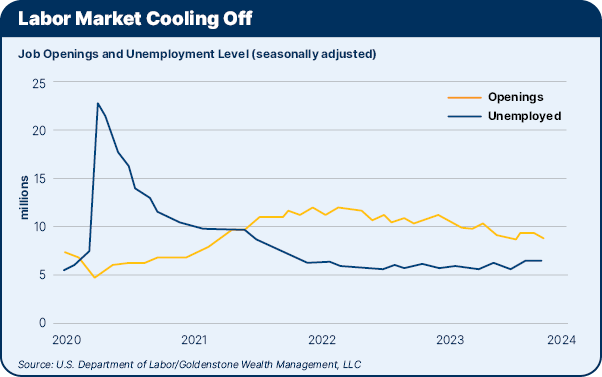

Additionally, there are signs labor demand is starting to cool, with unemployment rising to 3.8% in August. We expect investors to pay close attention to loan delinquencies in the coming quarters for signs that the consumer is pulling back.

Housing Remains a Wild Card

Homebuyers now face the highest mortgage rates since early 2002 with resultant low affordability. Data shows the U.S. housing market has slowed from its pandemic peak.

The number of active listings is significantly below levels from the last decade. It’s also approaching levels seen during the depths of the pandemic, when the economy was shut down.

Why are fewer homeowners listing their homes for sale? The effective rate on all outstanding mortgages is 3.6%, significantly below the 7% rate buyers would pay on a new mortgage. Homebuyers are simply not incentivized to sell and give up their low mortgage rate, especially with home prices still elevated.

Combining the impact of elevated mortgage rates, reduced affordability, and the shrinking inventory of homes, the number of mortgage applications is significantly below the average from 2017 to 2022. Home sales are still taking place, but the volume of sales has declined.

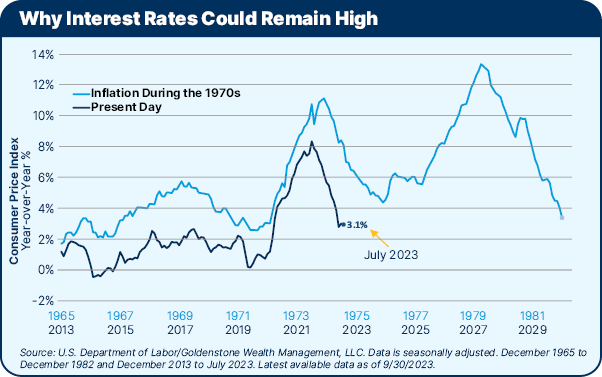

Inflation Fears Have a History Lesson

Comparing the path of inflation during the 1970s and today, the numbers differ, but a similar pattern emerges. In both periods, inflationary pressures began building early when interest rates were low in the 1960s and 2010s, respectively. Inflation subsequently eased as economic activity slowed around the 1970 recession and the 2020 pandemic.

However, inflation later reversed higher in both periods, with oil prices spiking in the early 1970s and supply chain disruptions following the pandemic. In both instances, the Fed responded by aggressively raising interest rates, causing inflation pressures to ease.

However, the 1970s serve as a cautionary tale, as inflation reaccelerated to more than 13% by the end of the decade. The rapid rise in inflation prompted the Fed to take drastic action and raise the federal funds rate to a staggering 20% in early 1980.

An inflation resurgence like the late 1970s is the primary risk today, which is why the Fed is hesitant to declare victory despite the recent dip in inflation. The Fed’s fear is that the economy will reaccelerate and inflation will run away, like in the late 1970s.

While this is not necessarily the Fed’s forecast, the recent rise in oil prices highlights the risk of persistent inflation.

The Fed is determined to avoid repeating its errors from the 1970s, and the implication is that the Fed may decide to keep interest rates higher for longer. This could keep the cost of capital high, with monthly payments on homes and vehicles remaining elevated.

Likewise, businesses may continue to find it more expensive to fund operations, finance inventory, and reinvest in their businesses.

Given this uncertainty, it is wise to take a long-term perspective when dealing with interest rates. You can put yourself in a difficult position if you take out a loan with the expectation of refinancing, only to find that rates remain high.

The worst may be behind us as uncertainty recedes. As consumer spending cools, all eyes are on the holiday retail sales, which are estimated to go up 5%. If inflation continues to descend, the consumer does not collapse, earnings grow as expected, and housing stays stable, we could see 2024 bring renewed enthusiasm and optimism about the economy and markets.

Staff Contact: Nicole Wasylkiw

This economic outlook report is adapted from the special report presented to the CalChamber Board of Directors by Dr. Sanjay Varshney, Ph.D., CFA, principal, founder and chief economist, Goldenstone Wealth Management, LLC.