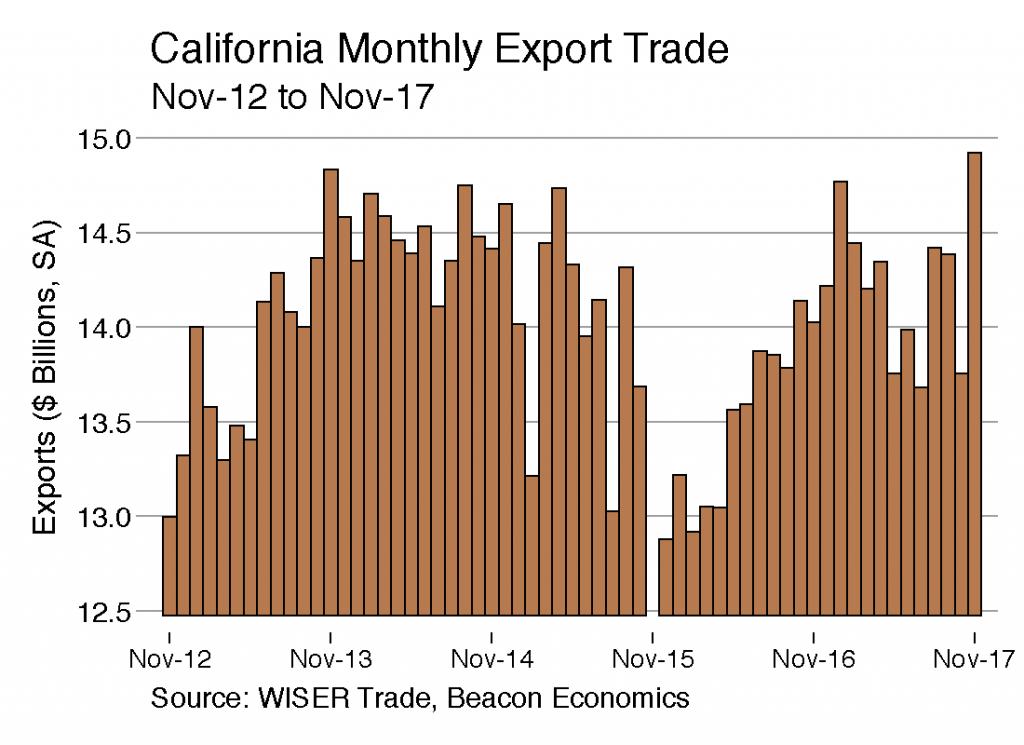

California’s merchandise export trade soared in December, according to a Beacon Economics analysis of U.S. trade statistics released February 6 by the U.S. Census Bureau.

Foreign shipments by California businesses totaled $15.32 billion for the month, a 9.1% gain over the $14.04 billion recorded in December 2016.

The state’s exports of manufactured goods in December rose 5.6% to $9.56 billion from $9.05 billion one year earlier. Exports of nonmanufactured goods (chiefly agricultural products and raw materials) jumped by 32.4% to $2.25 billion from $1.70 billion. Re-exports, meanwhile, rose by 6.7% to $3.51 billion from $3.29 billion.

California accounted for 11.3% of the nation’s overall merchandise export trade in November. Through the first 11 months of 2017, the state’s exports were running 4.7% ahead of 2016.

California accounted for 11.2% of the nation’s overall merchandise export trade in December. For 2017 as a whole, California’s merchandise exports totaled $171.93 billion, up 5.1% from the $163.62 billion recorded in 2016.

California Imports Surge

The U.S. Census Bureau reports that California was the state of destination for 19.1% of all U.S. merchandise imports in December, with a value of $38.29 billion, 6.2% higher than the $36.05 billion in imported goods in December 2016. Manufactured imports totaled $34.24 billion, up 3.9% from $32.95 billion. Nonmanufactured imports were valued at $4.05 billion, 30.2% higher than the $3.11 billion recorded one year earlier.

For the entire year, merchandise imports into California totaled $440.71 billion, up 7.4% from the $410.33 billion recorded in 2016. California reportedly accounted for 18.8% of the nation’s merchandise imports in 2017.

A Closer Look at The Numbers

As always, Beacon Economics cautions against reading too much into month-to-month fluctuations in state export statistics, especially when focusing on specific commodities or destinations. Significant variations can occur as the result of unusual developments or exceptional one-off trades and may not be indicative of underlying trends. For that reason, Beacon Economics compares the latest three months for which data are available (October–December) with the corresponding period one year earlier.

Leading Export Commodities

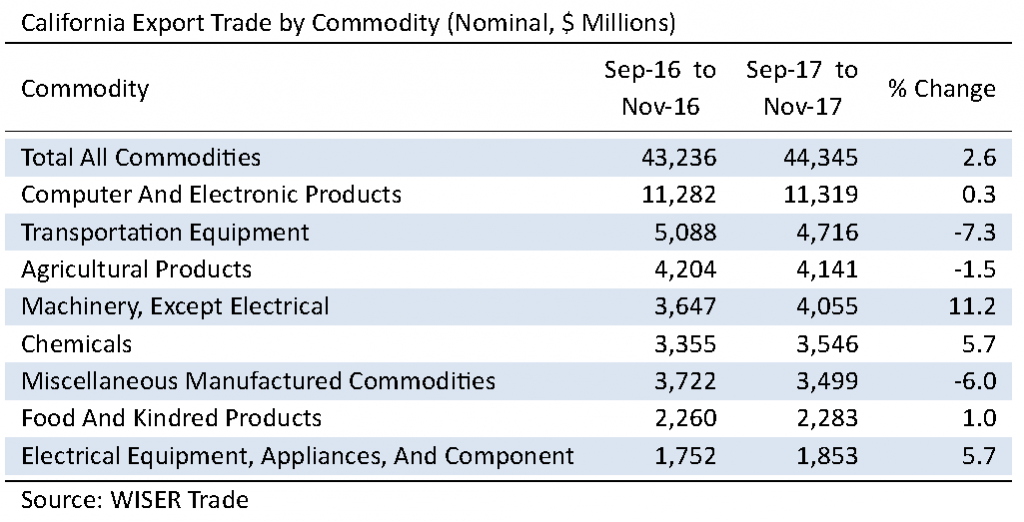

California’s merchandise exports during the last quarter of 2017 totaled $45.47 billion, a nominal gain of 4.2% over the $43.65 billion during the same period in 2016. Of the state’s 10 leading categories of exports, all but two saw increases.

On the plus side, shipments of Computer & Electronic Products (computers and peripherals; communication, audio, and video equipment; navigational controls; and electro-medical instruments) edged up by 2.9% to $11.74 billion from $11.40 billion. Exports of Non-Electrical Machinery (machinery for industrial, agricultural and construction uses as well as ventilation, heating, and air conditioning equipment) improved by 17.1% to $5.40 billion from $3.85 billion.

Agricultural exports increased by 7.1% to $4.51 billion from $4.21 billion. Chemical exports (including pesticides and fertilizers; pharmaceutical products; paints and adhesives; soap and cleaning products; and raw plastics, resins, and rubber) gained 5.1% to $3.56 billion from $3.39 billion.

Shipments abroad of Food & Kindred goods moved up 5.1% to $2.42 billion from $2.31 billion. Exports of Electrical Equipment and Appliances grew by 6.3% to $1.90 billion from $1.79 billion. Exports of Fabricated Metal Products were up by 3.7% to $1.05 billion from $1.02 billion. Exports of Petroleum and Coal Products surged by 67.3% to $1.39 billion from $828 million. Waste & Scrap exports rose by 39.8% to $1.28 billion from $918 million. Exports of Primary Metal Manufacturing products grew by 5.5% to $837 million from $793 million.

On the downside, the state’s exports of Transportation Equipment (automobiles, trucks, trains, boats, airplanes, and their parts) tumbled by 16.4% to $4.52 billion from $5.4 billion. Shipments of Miscellaneous Manufactured Commodities (a catchall category of merchandise ranging from medical equipment to sporting goods) fell by 8.2% to $3.21 billion from $3.49 billion.

Destinations

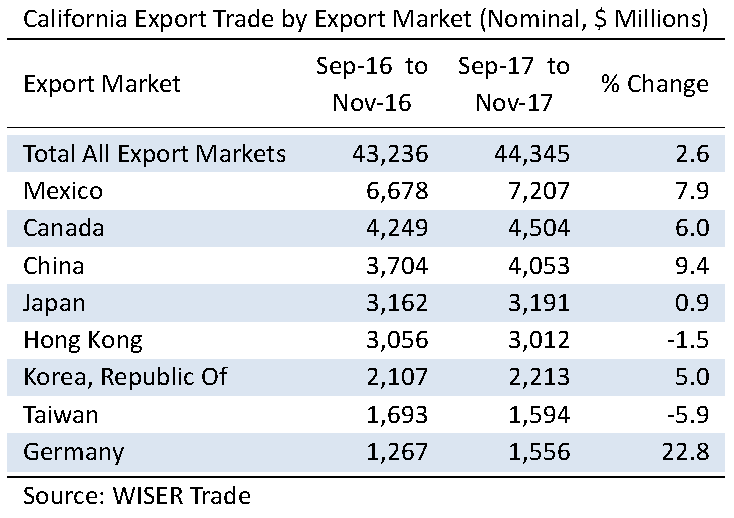

Mexico kept its position atop the list of California’s most important export destinations during the final quarter of 2017. Shipments south of the border grew by 8% to $7.12 billion from $6.59 billion. Canada was the state’s second largest export market, growing 10.4% to $4.59 billion from $4.15 billion. Exports to China rose 10.1% to $4.43 billion from $4.02 billion. In fourth place was Japan, which imported $3.34 billion worth of California goods, an increase of just 2.0% from $3.28 billion during the same period a year earlier. Hong Kong (4.1% to $2.99 billion from $2.87 billion) rounded out California’s Top Five export destinations during the latest three-month period.

The state’s export trade with the economies of East Asia edged up by 2.4% to $16.79 billion from $16.39 billion. Meanwhile, California’s exports to the European Union rose by 6.3% to $8.11 billion from $7.63 billion. Emphasizing the economic importance of the North American Free Trade Agreement (NAFTA), Mexico and Canada alone accounted for 25.8% of California’s merchandise export trade in the latest quarter, up from 24.6% one year earlier.

Mode of Transport

During the most recent three months, 46% of the state’s $45.47 billion merchandise export trade went by air, while waterborne transport carried 31.3% of the outbound trade. The balance of exports travelled overland to Canada and Mexico.

Outlook

Beacon Economics considers the near-term outlook for California’s exporters as generally optimistic, given the anticipated growth trajectories of the state’s trading partners, but comments that it continues to be “clouded” by President Donald Trump’s “mercurial trade policies.” The fate of NAFTA remains unclear, and the President’s decision in January to impose tariffs on imports of solar panels and washing machines, Beacon predicts, “will almost certainly prompt an adverse reaction from the affected trading partners.”

Although the short-term prospects for growing California’s export trade remain solid from a purely economic perspective, the possibility of abrupt shifts in U.S. trade policy casts uncertainty on what should otherwise be a very good year for California trade.

Staff Contact: Susanne T. Stirling