The new year will bring in big changes to California politics and governance.

The new year will bring in big changes to California politics and governance.

Some 35 new legislators will start work in the State Capitol. A new (well, restored) President will re-claim the federal administration. Hundreds of new state laws will come into effect.

But one thing will stay the same: the state budget will be verging into deficit.

For the past four years, annual budget spending has outpaced revenues. Budgets have been balanced using reserves accumulated during the recovery from the pandemic, federal recovery funds, and short-term revenue and spending fixes, including a three-year, $16 billion increase in business taxes through 2026.

The nonpartisan Legislative Analyst recently released his annual Fiscal Outlook in anticipation of the January release of the Governor’s 2025–26 proposed budget. The Outlook serves as a baseline estimate of the budget before any new policies or economic forecasts from the Governor. It helps identify the magnitude and direction of any budget issues and gives the Legislature a heads up on fiscal context of the upcoming year.

Analyst Findings

The Analyst’s key findings include:

- Revenues are coming in slightly ahead of forecast but are the result of a run-up in stock markets boosting upper-income taxpayers, not in an overall improvement in the economy.

- State spending also has accelerated over budget estimates, offsetting the increase in revenues, but not by so much as to present a crisis in the budget year, in the absence of other developments.

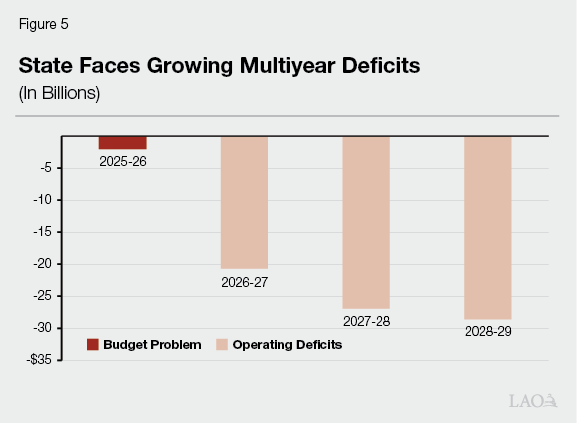

- The outlook for future budgets is more daunting. The Analyst projects future spending to continue at a historically rapid rate in the succeeding four years, averaging nearly 6%, compared with an average spending rate more recently of 3.5%. Out-year revenue growth is estimated at just 4%, which will create substantial deficits in just a few years (see chart).

- Key out-year spending pressures are from in-home care programs, increased Medi-Cal spending for an aging population, and higher costs from the health care minimum wage enacted in 2023 and fully taking effect this year.

State Economy

An abiding concern for the Analyst is the underperformance of the state’s economy, which he describes as “lackluster” and “sluggish.” Apart from the government and health care sectors, employment has not grown in the state in 18 months. Compared to historical averages, consumer spending is down, as is business owner income.

Outside influences will have a profound effect on the shape of the California economy, which in turn will affect its fiscal health. The new federal administration’s proposals for aggressive new tariffs and enforcement of immigration laws could dampen business growth for sectors sensitive to international trade and labor markets. California leans heavily into these sectors.

The trend in monetary policy will also affect markets, especially if the trend in cutting interest rates is interrupted by fears of renewed inflation or other economic pressures. Both federal and state policies will influence the long-term health and productivity of the California economy.

The challenge for the Legislature in 2025 will be to reconcile accelerating spending trends with modest revenue growth — and doing so without undermining an already underperforming state economy.