Far from losing steam, the U.S. economy has been on a solid upswing lately. But as always, a deeper look at the data suggests that there are issues to keep an eye on, according to a recent report by the California Chamber of Commerce Economic Advisory Council.

Far from losing steam, the U.S. economy has been on a solid upswing lately. But as always, a deeper look at the data suggests that there are issues to keep an eye on, according to a recent report by the California Chamber of Commerce Economic Advisory Council.

The United States is currently in the midst of the second longest expansion in the nation’s history at 111 months and counting. In July of next year, we will officially be in the midst of the longest expansion on record.

Below are some of the highlights from the economic report.

Read the full report or download PDF.

A Deeper Look

Consider some recent statistics.

- U.S. gross domestic product (GDP) growth in the second quarter came in above 4%, the best reading since 2014 and driven by strong growth in business and consumer spending.

- Industrial production is up 4% from one year ago—another recent best.

- Employment growth over the last 3 months has totaled more than 200,000 jobs added per month, even with unemployment below 4%. More importantly, the job openings rate is at 4.2%, suggesting that employers would hire even more workers, if they could find them.

The recent GDP release came with (as is usual every couple of years) a revision of the last few years of data on the basis of better data and improved techniques. While the revision didn’t change much in terms of the estimation of economic output, it did change the estimated flow of income.

Temporary Surge

As positive as all this news is, don’t be fooled into believing the U.S. economy has truly achieved a new pace of growth. Scratch away at the surface and there are any number of reasons to conclude that the current growth surge is, at best, temporary. At worst, the seeds of the next recession are possibly being sown in these current numbers.

- First, we need to take a bit of a gut check on the recent numbers. The 4.1% growth rate in the second quarter was certainly impressive. But most of that growth came from a surge in consumer spending—an anticipated surge given the weak first quarter for consumer spending growth.

- Second are the international trade battles currently in play. While the problems with the European Union seem to be on hold for the moment, the U.S. disputes with China are growing worse with both sides continuing to ratchet up the tariffs being levered on the other. Much has been made of the effects on U.S. exporters to China, particularly those that export agricultural products. But the U.S. imports almost four times as much from China as it exports to them. And what we do import are critical components of U.S. supply chains. As solid as industrial production looks from a growth perspective, recent data suggests overall production is starting to plateau.

- Lastly, there is the Federal Reserve. Inflation has heated up as of late with the Consumer Price Index (CPI) getting close to 3%, the fastest since 2011. Beacon Economics, however, still doesn’t believe there is a real chance of higher permanent inflation. M2 growth remains below 4%, and bank lending is tepid.

State Forecast: OK for Now

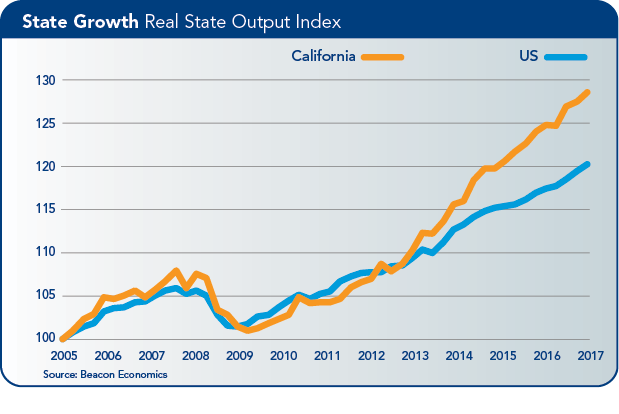

With two quarters down and sights turning toward the last part of the year, it is apparent that the California economic engine continues to hum along, much like the nation as a whole. Job gains have been steady and the state’s leading industries have expanded despite ongoing concerns on the international trade front.

Still, good news notwithstanding, anxieties linger about California’s extremely tight housing market and the resulting affordability challenges it presents, and the long-term consequences of slow growth in the state’s labor force.

2018 Shaping Up to Be Good Year

California continues to land in record territory, with its unemployment rate at 4.2% for the fourth month in a row as of July 2018. At the same time, job growth so far this year has outpaced 2017 by a slim margin, with wage and salary jobs in July increasing by 2.0% or 332,700 jobs compared to one year earlier.

Of the 332,700 jobs added in July, Health Care and Leisure and Hospitality each contributed 58,000 positions, or more than one-third of the total, with Construction, Professional Scientific and Technical Services, and Transportation and Warehousing also reporting sizable gains among the private sector industries. This set of industries has consistently made the largest contributions to job gains in the state over the last several years.

The Government sector added to its ranks as well, increasing by 33,300 workers with roughly two-thirds of the increase occurring in Local Government and one-third in State Government (the Federal Government trimmed 2,500 jobs).

All but one of the state’s major industries experienced job gains in July, with only Mining and Logging seeing a loss of 300 jobs.

Steady Job Gains

Similarly, headline numbers for California’s gross state product (GSP) and taxable receipts reveal continued growth in the statewide economy in the first part of the year.

Both the coastal and inland regions of the state have enjoyed economic and job gains for several years running. Through the first seven months of this year, every metro area in California experienced job growth. Across the large metro areas, job gains in the San Francisco Bay Area reflect the staying power of the tech sector, with the largest absolute and percentage increases occurring in San Jose.

In Southern California, the Inland Empire has consistently registered the largest percentage gains in jobs for the last couple of years, although Los Angeles County generally reports the largest absolute gains because of its size. Much of the growth in the entire region has come from Health Care, Professional Scientific and Technical Services, Construction, and Logistics. Metro areas in the Central Valley have also seen employment growth overall, supported by job gains across a variety of sectors.

Housing: Mixed Performance

California’s housing market has been a mixed bag so far this year. According to the California Association of Realtors, the monthly median home price in California finally surpassed its pre-recession peak earlier this year, a long-awaited milestone that signifies how far the market has come.

The median price in the state was $591,460 in July, up 7.6% year-to-year, continuing a string of yearly price gains going back several years. Still, home sales have been average, at best, and disappointing when considered against the backdrop of the state’s long economic expansion.

New home construction moved up a notch in the first half of this year compared with last year, a development that should also temper, but not halt, price increases. Overall, housing permits rose 9.4% in the first half of 2018 compared to one year earlier, with increases of 7.3% in single-family permits and 11.4% in multi-family permits.

The state is on track to add about 130,000 new units this year, still far below its needs, which are closer to 200,000 units annually. As long as home construction lags behind what the state needs, high housing costs will be a painful thorn in the side of the California economy.

Long-Run Concerns Linger

High housing costs impede California’s economic growth over the long term to the extent that these costs serve as a deterrent to labor force growth.

If anything, the longer-term story that emerges is more concerning. Over the last few years, the growth rate of California’s labor force followed roughly the same direction as the growth rate of the U.S. labor force—until the second half of 2017, when California’s growth rate began a steady decline even as the U.S. growth rate has accelerated in recent months.

In looking at the future growth trajectory of the California economy, the elephant in the room is the high cost of housing and its impact on labor force growth.

This is no accident: the California median home price has consistently been more than double the national median home price for several years. The rental market is no different, with a number of California metro areas ranking among the least affordable rental markets in the nation.

As growth in the state’s labor force slows further, it will tighten like a noose on the economy and limit future growth and business development.