Insurance and risk management basics and the factors contributing to the insurance crisis were the focus of a briefing for legislators and staff members co-hosted by the California Foundation for Commerce and Education (CFCE) and Senator Susan Rubio, chair of the California Senate Insurance Committee.

David T. Russell, Ph.D., professor at California State University, Northridge, provided the overview at the June 10 briefing. Russell works with The Institutes Griffith Foundation and its nonprofit, nonpartisan, nonadvocative educational affiliate.

Senator Rubio (D-Baldwin Park) has chaired Senate Insurance for seven years and said understanding the basics of insurance policy is “crucial to better engage in policy discussions.”

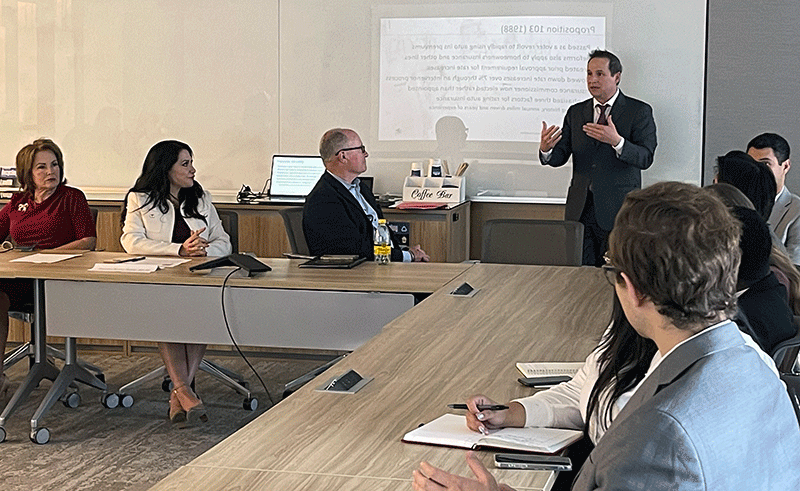

Senator Susan Rubio (second from left) co-hosts the briefing on the insurance crisis.

Briefing Topics

The policy briefing and the slide presentation reviewed for attendees:

- How the insurance industry works and why the insurance market behaves the way it does.

- Insurance terms and why some risks are difficult to insure.

- Key insurance regulations affecting insurance.

- Factors affecting insurance pricing and why solvency is so important to insurance companies.

- Ways to protect consumers.

- The California FAIR Plan, the fire insurance pool established by law in 1968 to help California homeowners who can’t find insurance in the traditional marketplace. The pool is made up of all insurers licensed to conduct property/casualty business in the state.

Working Together

“As the insurance crisis affects more and more people in California, it is important for legislators and staff to have access to information that will get them up to speed on this critical issue,” said Rubio. She expressed her appreciation to the legislators and staff who attended the briefing, adding “I look forward to continue our discussions and work solving the insurance crisis in California.”

CFCE is a nonpartisan, nonprofit research organization affiliated with the California Chamber of Commerce.

Contact: Luis Quiñonez