U.S. Economic Outlook

This year’s Lunar New Year ushered in the Year of the Rat on the Chinese calendar. The past year, the Year of the Pig, might more fittingly be labeled “year of the bear” given the number of grim outlooks for the U.S. economy that were offered up by economists and pundits.

Whether it was the inverted yield curve, the trade war with China, a residential real estate meltdown, or some other perceived economic calamity, there were a lot of bets that the now record-long expansion was going to come to an end, and soon.

Yet as we move through the first quarter of 2020, incoming data from 2019 doesn’t indicate anything that signals an impending recession. While the quarter-to-quarter data for the year was quite volatile, overall, 2019 saw U.S. GDP grow at about a 2.3% pace—just slightly slower than the year before. There was a slowdown in business investment—but this was made up for by falling imports and a pickup in public spending.

Looking ahead, Beacon Economics’ expectation is that U.S. GDP growth in the first quarter of 2020 will be in the 1% to 2% range. For the year overall, expect a modest rebound and growth in the 2% range. Employment growth will slow, but only because of a tight labor market and the difficulty employers face in filling open positions. Rumors of this expansion’s imminent demise continue to be highly exaggerated.

Other economic indicators from the past year are also positive. Residential real estate markets have returned to “normal” in terms of sales, and prices are accelerating again. There were 2 million jobs added to the payroll workforce last year and unemployment has remained low. Data from the Atlanta Fed shows worker wage growth accelerating in 2019 over 2018, and savings rates picked up to 8% by the end of the year. Interest rates are low, as is inflation. The bearish headlines have started to diminish along with the fear of an impending recession. This will come as good news for President Trump’s reelection bid and will remain a central point in his pitch to voters.

Wildcards

There are still wildcards out there related to the economy. To date the coronavirus has had only modest effects compared to a normal flu season. However, the potential for the virus to spread is evident and it remains an unknown as to how long it will take to contain. This situation could grow worse and have an impact on an already-fragile global economy. Additionally, the stock market is currently in full bubble mode and there are hints that other financial irregularities are popping up in nonbank lending channels. But none of these appear close to having the power to derail the current economic expansion.

Turning to Washington, that the economy is not tipping headlong into another downturn is no vindication of the Trump administration’s policies since taking office. This administration inherited a strong economy with one of the healthiest consumer bases in 30 years—doing nothing would have been sufficient to maintain growth.

This is not, however, the election year narrative President Trump and his campaign are promoting, as evidenced so well in the recent State of the Union address. In that address, the President claimed that the U.S. economy had been floundering under the previous administration, and that his policies were responsible for reinvigorating it.

Economic Weakening

But even a cursory look at the data contradicts that and even more, suggests that the U.S. economy is weaker now than it was two years ago when the current administration took over. Moreover, this weakening has occurred despite a strong hit of stimulus from both fiscal policy and falling interest rates.

There are a number of global issues far beyond the control of the White House that explain some of the economic weakness. But a portion of it can be linked directly to current U.S. policy choices related to issues such as trade and immigration. And perhaps most important is that the capstone achievement of this administration—the 2017 Tax Cuts and Jobs Act—has had no positive impact on the economy at the expense of today’s trillion-dollar deficit.

This certainly isn’t an endorsement of the Democrats’ platform—whatever it may look like when (and if) this primary season ever ends. The rhetoric being thrown around by the many candidates still in the running focuses on ideas and initiatives that poll well with the political base but are not tackling the real, and most pressing, economic issues facing the United States.

Avoiding Issues

Indeed, avoiding the real issues—such as entitlement reform, underinvestment in infrastructure, a broken tax system, and a massive federal deficit—seems to be the only true bipartisan effort going on within the nation’s political establishment. Neither side has concentrated on these issues and that is the most frightening trend of all.

It adds up to a nation that is squandering a period of unprecedented prosperity, a time when it could start to take on the big problems of our era, to instead battle over populist policies and political power.

Still, these long-run worries will not offset the economy in the year ahead. Here are the highlights and lowlights of 2020 as Beacon Economics sees it.

Positive Trends

Consumer spending growth in 2019 slowed from the year prior—but this is explained by the one-time impact on the economy that occurred in 2018 as a result of the Tax Cuts and Jobs Act. Still, at 2.5%, consumer spending growth in 2019 was faster than overall U.S. GDP growth (2.3%). Interestingly, the savings rate increased in 2019 to a high of 8% in the final quarter of the year.

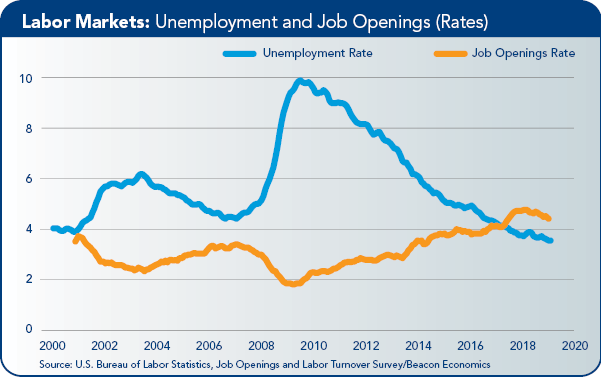

The ability of households to both save and spend more than the nation as a whole was due to tight labor markets that saw national income shares shift toward workers.

With tight labor markets, a low debt burden, strong financial markets and low interest rates, there is nothing to hold the consumer back in 2020 — except uncertainty. A solid consumer sector will be the keel on the U.S. economy as it races through rougher global waters.

Residential real estate markets, as predicted, turned the corner sharply in the second half of 2019 with recovering sales and an uptick in construction activity. The markets will also have a good year ahead with low mortgage interest rates, rising ownership rates, and very tight inventories boosting prices.

Interest rates will also be favorable in 2020. Inflation was never a serious threat to the economy, and core rates are still below the Fed’s target. This means that the chance of the Fed loosening again is greater than the chance of its tightening. But the greatest odds may be that the Fed largely stands pat until after the 2020 presidential election.

Neutral Trends

A positive trend for the U.S. economy has been the jump in public spending at the national level. But this increase has been funded, along with tax cuts, by a huge surge in federal borrowing. While this clearly represents stimulus in the economy, it comes at a high future cost by making a bad fiscal balance problem even worse. As such, Beacon Economics sees this as a neutral for the economy… for now.

Trade is also a neutral for the U.S. economy. Last year the national economy showed almost no impact from the trade war with China. Yes, the flow of goods between the United States and China slowed sharply, but on balance, the U.S. simply bought more from other countries and sold more to other countries.

Overall trends in real U.S. imports and exports was flat last year with the trade deficit closing slightly. On net, the impact on U.S. GDP was slightly positive, but we can also observe that the trade disruptions had much to do with the slower pace of business investment.

Overall, U.S. exporters and importers have shown remarkable resiliency in the face of not only tariff wars, but also a weaker global economy and a strong U.S. dollar. While things are looking up for the international economy, it will not drive U.S. trading activity to new heights in the near term.

Additionally, there are plenty of reasons to believe the U.S.-China conflict is not over and President Trump seems intent on creating more issues for the United States’ European Union trading partners—for example, threatening to levy tariffs on European cars.

Negative Trends

One big issue for the U.S. economy is a lack of workers. For two years now, the job openings rate has been higher than the official unemployment rate. This worker scarcity issue is causing businesses to struggle to fill positions and is clearly one reason for slower growth. Expanding flows of immigrant workers to the U.S. would have positive economic effects but is politically untenable under the current administration.

Business investment is also weak, despite corporate tax cuts and deregulatory efforts. The reasons for this are numerous. The trade disruptions and weak global economy are partly to blame. Weak profit growth and low oil prices are also at fault. And we have the negative effect that slower workforce growth has on the demand for commercial construction—intensified by big changes in the distribution systems within retail markets.

Finally, we have to consider current, short-term disruptions. The Boeing 737 MAX debacle will have some impact this year, as will slower tourism due to the ongoing coronavirus pandemic. The scope of these impacts, however, is yet to be seen. Pile on the unease of a heated election season in a divided nation and it’s not surprising that businesses are shying away from increased investment.

Add it all up and 2020 will be an interesting year for the U.S. economy—but not as interesting as the political scene. Unfortunately, that doesn’t imply interesting in a good way. Rather, it is like watching a slow-moving train wreck.

The broken and tribal nature of U.S. politics today means that the nation’s leadership will almost assuredly continue to squander opportunities to address pressing long-term issues. Fixing our political system and reducing divisions may be the most important things that can be done to ensure a healthy national economy into the future.

California Economic Outlook

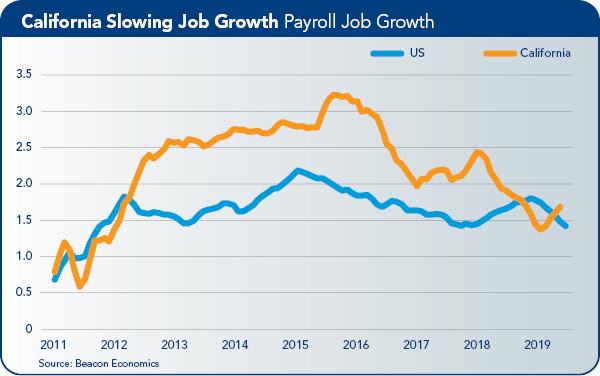

The final quarter of 2019 brought to a close another strong year for the California economy. During the year, 310,300 jobs were added to total nonfarm payrolls in the state. This represented a growth rate of 1.8% for the year, and compared favorably to 2018, when 260,400 nonfarm jobs were added by the state’s nonfarm employers, a growth rate of 1.5%

The state’s strong fourth quarter paints a picture that is a far cry from the beginning of the year, when the stock market had just seen a major correction, there was anxiety about trade uncertainty, and forecasts about a national and global slowdown were coming from all quarters. The fears surrounding trade, for now, seem overblown, and there is no evidence that we are on the cusp of a turndown in economic activity.

Yet as California’s economy continues to soar, questions remain about the growth of the state’s labor force and the out-migration of low-income workers. And with another defeat for SB 50—the state’s ambitious effort to increase housing construction though density increases in cities—the state’s housing shortage remains cause for worry.

Another Strong Employment Year Caps a Strong Decade

The fourth quarter of 2019 marked the end of a decade of strong expansion for the California economy. Over the past decade, nearly 3.5 million nonfarm jobs were added to the state, at a growth rate of 23%. In the preceding decade, fewer than one-quarter of a million jobs were added to California’s economy, a growth rate of 1.5%.

These numbers are obviously skewed by the business cycle: the first decade of this century ended during the depths of the “Great Recession,” while the last decade ended in the midst of the nation’s longest economic expansion on record.

That said, California’s rate of job growth over the past decade was not only impressive compared to the previous decade, but also when compared to the entire nation, where the rate of job growth was 18%.

Within California, job growth has varied by region. Over the past year, Los Angeles County added 66,500 jobs, more than any other county in the state. This is a function of LA County’s size—it’s the largest in the state and nation—where a small percentage increase in jobs can lead to a large number of total jobs added. In terms of growth rate, the number of jobs in the county grew at a 1.5% rate, slower than the state average.

The fastest growth was in the Yuba City Metropolitan Statistical Area (MSA), where jobs grew at a 4% rate. Given the relatively small size of this area, this rate of growth equals just 1,700 jobs, which, while important to the local economy, accounted for less than 1% of the state’s job growth.

The most impressive combination of absolute job growth and percentage increases occurred in San Diego County at 34,500 jobs and 2.3% growth, the San Jose MSA at 33,200 jobs and 2.9% growth, the Inland Empire at 30,800 jobs and 2.0% growth, and the San Francisco MSA at 29,800 jobs and 2.6% growth.

Employment Growth by Industry

In terms of relative growth by job sector, Educational Services, Construction, and Health Care and Social Assistance saw the biggest employment gains, while the highest number of jobs was added in Health Care and Social Assistance and Government.

Long-term trends, particularly an aging population, will continue to drive job growth in Health Care and Social Assistance. Modest job losses occurred in Retail Trade and Wholesale Trade. In relation to Retail Trade, the continued trend toward ecommerce will suppress employment prospects for physical retail businesses.

Beacon Economics is forecasting that employment in California will grow by 1.83% in 2020 or 322,561 jobs. Growth will continue in 2021 with employment forecast to expand by 1.43%, or 252,209 jobs.

Labor Force/Housing Shortages

After five months of no growth or negative growth, California’s labor force finally expanded in December 2019, although growth was down for the quarter overall, and December’s growth was below the trend since the “Great Regression.” This naturally raises questions about the state’s housing market, and more specifically, the extent to which local governments have created a conducive environment for creating new, badly needed housing.

The number of housing permits issued in the state peaked in the first quarter of 2018 and has trended lower since then. Even before this downturn, the state was in the midst of a housing shortage. As the shortage persists, it will create two primary effects. First, it will put upward pressure on housing prices, exacerbating affordability problems, and second (relatedly), it will shape the nature of the state’s labor force.

Domestic net migration patterns reveal a worrying trend: California has lost more population to other states than it has gained from them. These losses have been offset by international migration to the state, but the nature of domestic net migration raises red flags. California has been losing low-income workers to other states, while also losing workers with lower levels of education as housing shortages are rendering California relatively inaccessible for these residents.

Trading Trends

The recent tariff war truce between the United States and China will be welcome news for California’s trade businesses, as 2019 marked downward years for both imports to and exports from the state, compared to 2018. Removing the uncertainty surrounding U.S. trade policies, if only in the short-term, should help to improve the picture in 2020. How this plays out, however, is yet to be seen.

Overall, 2019 marked a strong year for the state’s economy, and this trend is expected to continue in 2020.

The California Chamber of Commerce Economic Advisory Council, made up of leading economists from the private and public sectors, presents a report each quarter to the CalChamber Board of Directors. The council chair is Christopher Thornberg, Ph.D., founding partner of Beacon Economics, LLC.