Trading Partner Portal: India

Overview

Boom Time for India Promises Benefits for Relations/Trade with U.S., California

CalChamber, December 13, 2022

Interview Series Featuring California’s Key Trading Partners – Featuring Ambassador Dr. T.V. Nagendra Prasad, Consul General of India in San Francisco: Robust Relations, Cross-Border Startups Create Jobs, Trade Benefits Across Sectors

CalChamber, January 8, 2021

Trade Overview

Over the last decade, India’s developing economy has emerged to become an important player in the global market. With a workforce of over 500 million —over three times the workforce of the U.S.—India has the human capacity to sustain large and rapid development. India’s population makes up about 17% of the world’s population, and the country makes up 2.4% of the world’s surface area. Its nominal GDP in 2024 totaled $3.89 trillion, and its populations totaled over 1.44 billion people.

Over the last decade, India’s developing economy has emerged to become an important player in the global market. With a workforce of over 500 million —over three times the workforce of the U.S.—India has the human capacity to sustain large and rapid development. India’s population makes up about 17% of the world’s population, and the country makes up 2.4% of the world’s surface area. Its nominal GDP in 2024 totaled $3.89 trillion, and its populations totaled over 1.44 billion people.

As of 2024, India is the world’s 6th largest economy and has a thriving middle class. As both a service-based and an agricultural economy, the country has seen strong growth in both sectors. The service industry has become an integral component of the Indian economy, making up 65% of the GDP while containing only 28% of the workforce.

Agriculture, on the other hand, is the most popular sector, representing 53% of the workforce, but only 17% of the GDP. Policies of economic liberalization, first implemented in the early 1990’s, have created a trend of steady economic growth—averaging 7% since 1997.

U.S. – India Trade

The reduction of controls on foreign trade and investment has opened the country to new opportunities and markets, which have sustained this pattern of growth. In 2024, the United States exported $41.54 billion to India. Top exports included oil & gas ($7.82 billion), chemicals ($5.08 billion), miscellaneous manufactures ($3.90 billion), computer and electronic products ($3.79 billion), and transportation equipment ($3.72 billion). Two-way trade totaled $128.88 billion in the same year.

India ranked 10th in U.S. import markets, with the U.S importing a total of $87.34 billion in goods in 2024. The largest category of these imports being chemicals at $18.18 billion. Other top imports included miscellaneous manufactures ($12.50 billion), computer and electronic products ($11.94 billion), non-electrical machinery ($5.66 billion), and apparel and accessories ($4.96 billion).

California – India Trade

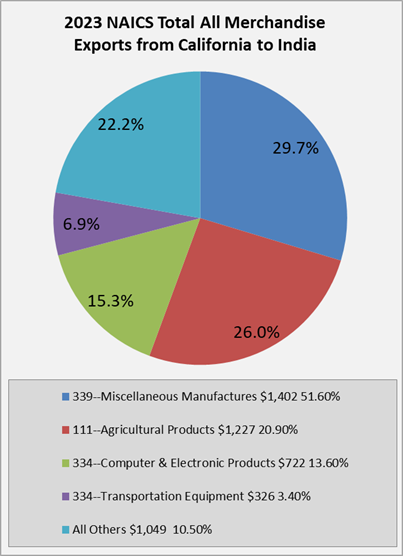

India is currently California’s 12th largest export destination. In 2024, California exports to India brought in over $4.50 billion, making up 10.8% of the U.S. total. California is a top exporting state to India. Top export categories included agricultural products ($1.22 billion), miscellaneous manufactures ($1.16 billion), computer and electronic products ($923 million), chemicals ($248 million), and waste and scrap ($194 million).

In this same year imports from india to the U.S. totaled $7.35 billion, a 2% increase from 2023. Top imports from India included computer and electronic products ($1.92 billion), miscellaneous manufactures ($1.03 billion), petroleum and coal products ($801 million), livestock and livestock products ($457 million), and textile mill products ($444 million).

U.S. Department of Commerce

FDI – India

Some 579,000 travelers visited California from India in 2024 and spent an estimated $1.50 billion in the state (Visit California). California is also the leading destination state for Indian immigrants, home to 20% of the total nationwide. the largest Indian communities in California were found in the Bay Area (Bay Area Council).

According to the most recent figures in 2023, U.S. total stock foreign direct investment to India was $49.6 billion while Indian direct investment into the U.S. was $4.7 billion (Bureau of Economic Analysis). India FDI in the US is the third fastest growing, with Indian FDI supporting 71,900 jobs and invested $281 million into research and development. Another $1.9 billion went to expanding US exports. The top industry sectors for Indian FDI in the US were: software and IT services, business services, pharmaceuticals, industrial equipment, metals, and communications. Select USA

In California, the eighteenth largest source of FDI through foreign-owned enterprises (FOEs) is India. Indian FOEs in California provided 10,037 jobs through 285 firms amounting to $1.42 billion in wages in 2024. The top jobs by sector are professional & business services, information, wholesale trade, manufacturing, and transportation, warehousing & utilities (World Trade Center Los Angeles FDI Report).

India and the World

Major exports from India to the rest of the world include mineral fuels, including oil; gems, machinery including computers, vehicles; organic chemicals, pharmaceuticals, electrical machinery, iron and steel, cotton, clothing and accessories. Major imports into India from the rest of the world include: mineral fuels including oil; gems, precious metals, electrical machinery/equipment, machinery including computers; organic chemicals, plastics/plastic articles, iron; and steel, animal/vegetable fats, oils, waxes; optical, technical, medical apparatus; and inorganic chemicals. India’s major export partners include the US, UAE, Hong Kong, China, Singapore, UK, Germany, Bangladesh, Netherlands and Nepal. India’s major import partners include China, US, UAE, Saudi Arabia, Switzerland, Iraq, Hong Kong, South Korea and Singapore.

More Articles:

Seismic Shift – Economic Growth and Strategic Alignment Between the Bay Area and India

Bay Area Council, March 2023

Joint Statement from the United States – India Trade Policy Forum

U.S. Trade Representative, November 23, 2021

Report: The Bay Area-Silicon Valley and India: Convergence and Alignment in the Innovation Age

Bay Area Council, June 2019

India’s Film Industry: a Booming Opportunity

Visit California, November 2, 2018

California Business Roundtable Partners with NASSCOM to Promote Strong Bilateral Trade Engagements Through the Visit of Indian Union Minister for Electronics & Information Technology

CBRT, August 27, 2018

Trade Policy Review: India – World Trade Organization

January 2018 – Energy Update from the U.S. Commercial Service

The Indian market with its one billion plus population, presents lucrative and diverse opportunities for U.S. exporters with the right products, services, and commitment. India’s requirements for equipment and services for major sectors such as energy, environmental, healthcare, high-tech, infrastructure, transportation, and defense will exceed tens of billions of dollars in the mid-term as the Indian economy further globalizes and expands. As per the revised estimates released by Central Statistical Organization (CSO), India’s GDP growth for FY 2016-17 was 7.1%. With expected continuance of the government’s liberal policies and with soon to be implemented Goods and Services Tax (GST), India has potential for a sustained high growth for the next couple of years and the U.S. companies must seize the opportunities to enter the rising Indian market.

India is already a major renewable energy market (with the sixth largest renewable energy capacity) despite fossil fuels still accounting for 75 percent of its energy mix. A new national government commitment to clean energy should facilitate growth over the next several years. According to ITA’s projections, only two markets will install more renewable energy capacity through 2017 than India – China and Japan. To learn more about India as a top U.S. renewable energy export market, click here.

For the administration of Indian Prime Minister Narendra Modi, the largest and most perplexing challenge is arguably addressing India’s significant need for power. India currently is home to 18 percent of the global population, but only accounted for 5.7 percent of the global energy demand in 2013. India runs at an average energy deficit of 5 percent with values as high as 25 percent in some regions, leading to daily rolling brownouts, hampering economic growth and limiting foreign investment in the country. The July 2012 blackout that affected 620 million people was, for example, seen as a global embarrassment and remains a politically contentious topic to this day. To learn more about India as a top U.S. smart grid export market, click here.

Framework

Framework for Cooperation on Trade and Investment

The promise that United States-India trade holds is manifested in the “Framework for Cooperation on Trade and Investment” that was signed by U.S. Trade Representative Ron Kirk and Indian Minister of Commerce and Industry Anand Sharma on March 17, 2010. This agreement strengthens bilateral cooperation and builds on recent rapid growth in U.S.-India trade, which has more than doubled over the last five years.

“There is almost limitless potential for growth in trade between our two countries, and that can contribute to economic recovery and job creation in the United States and continued economic growth in India,” said Ambassador Kirk.

“We can realize that potential by working together toward the goals set forth in the Framework agreement, such as developing and enforcing policies that encourage technological innovation, increasing agriculture, services, and industrial goods, and increasing investment flows. Closer collaboration with entrepreneurs and private sector leaders in both our countries will enhance our work.”

The United States and India agreed to work together to support greater involvement by small and medium-sized enterprises in each other’s markets, and to pursue initiatives in the further development of India’s infrastructure, and collaboration on clean energy and environmental services, information and communications technologies, and other key sectors.

Under this agreement, the U.S. and India intend to meet the objectives of developing and enforcing trade policies and fostering a trade-enhancing environment by undertaking initiatives to help us meet those goals. Examples include increasing opportunities for private sector partnerships in infrastructure projects; enhancing IPR awareness and enforcement; promoting increased bilateral cooperation in the healthcare, education, information technology, energy and environmental services industries; working to empower women and disadvantaged groups; creating greater mutual understanding of respective approaches to government procurement; and SME development.

CalChamber Position

The California Chamber of Commerce, in keeping with long-standing policy, enthusiastically supports free trade worldwide, expansion of international trade and investment, fair and equitable market access for California products abroad and elimination of disincentives that impede the international competitiveness of California business. New multilateral, sectorial and regional trade agreements ensure that the United States may continue to gain access to world markets, resulting in an improved economy and additional employment of Americans.

Reasons for Position

- This Agreement is a critical element of the U.S. strategy to liberalize trade through multilateral, regional and bilateral initiatives.

- The FTA will increase momentum toward lowering trade barriers and set a positive example for other developing economies in the world.

Profile in Trade

What You Need to Know Before Exporting to India

In 2018, many industries are developing in India. The U.S. Commercial Service specifically notes the following where there is market entry opportunities and growth potential:

Aerospace

- At $16 billion, India’s aviation market is currently the 9th largest in the world and is expected to be the 3rd largest by 2020, and by 2030, potentially the largest.

- The Government of India is advancing $110 billion in civil aviation expansion and modernization projects through 2020.

- KPMG recently estimated India would require over 250 brown field and green field airports by 2020.

Agriculture

- India is an agrarian economy and more than fifty-two percent of the land area is considered arable.

- The Ministry of Food Processing Industries has an initiative to establish 42 mega food parks, 133 Cold Chain projects, 38 Abattoir projects, 101 Food Testing Laboratories and to provide assistance to 7,381 food processing firms for technology upgrades and modernization. The goal is to increase the level of processed food from the current 10 percent to 20 percent by 2019.

- India is known for a fledgling cold chain, which results in supply chain losses of food and other resources. The losses in agricultural sector alone are estimated at $14 billion annually due to inadequate infrastructure.

Defense

- India has the 3rd largest armed forces in the world and plans to spend billions in defense acquisitions over the next several years.

- India is the 4th largest defense spender, according to IHS Jane’s latest annual Defense Budgets report.

- It is one of the largest importers of conventional defense equipment in the world, importing approximately 60% of its defense requirements, according to the Government of India.

Energy

- India has the 5th largest power generation installed capacity in the world. Coal dominates the energy mix at 60 percent, but renewable sources are quickly expanding their share.

- The Ministry of New and Renewable Energy is developing a National Energy Storage Policy to fast–track adoption of new technologies in India.

- India has ambitious targets to continually increase the percentage of renewables within the overall mix of energy sources (15 percent in 2016) to 40 percent by 2030.

Healthcare

- The Indian healthcare industry is expected to reach $280 billion by 2020 due to increased demand for specialized and quality healthcare facilities.

- The Indian medical device market is worth an estimated $4.4 billion (without the inclusion of rural market potential) and is expected to exceed $7 billion by the end of 2020.

- Imports constitute fifty percent of the market for diagnostic kits, reagents, hand-held diagnostic equipment, and simulation for operating rooms. Hand-held/portable diagnostic equipment is also a fast-growing segment since India has around 45 million diabetics, which is expected to swell to 70 million by 2025.

Security

- The Indian cyber security market is currently estimated at $2.1 billion and growing at 10 percent annually.

- According to a leading security software firm, India ranked 3rd on a list of countries worldwide where the highest number of cyber threats were detected and 2nd in terms of targeted attacks in 2017.

- The Indian information technology trade association, the National Association of Software and Services Companies, expects the Indian IT industry to achieve a market size of $350-400 billion by 2025, and that the cybersecurity product and services segment would be $35 billion by 2025.

Growth in Export Opportunities Broadens Need for Financial Partners with Experience

(June 12, 2008) On average, 20th century Westerners — whether from Great Britain, Belgium, the Netherlands, the United States, Canada or Australia — had three times the material wealth and standard of living of their forebears the century before.

“The world is on the cusp of another explosive economic growth phase, this time in emerging markets such as India, Brazil and China,” says Sanjiv Sanghvi, chief executive officer of Wells Fargo HSBC Trade Bank. Full Article

Events

Boom Time for India Promises Benefits for Relations/Trade with U.S., California

(December 13, 2022) Trade and investment opportunities in India were the focus of attention at last week’s international breakfast meeting of the CalChamber Council for International Trade.

Ambassador Dr. Nagendra Prasad, consul general of India in San Francisco, and Ambassador Atul Keshap, president of the U.S.-India Business Council, pointed out the many historical and economic connections between California and India.

Both ambassadors commented that shared democratic values are an important component of the strategic partnership between India and the United States.

The December 9 breakfast meeting was sponsored by CalChamber Board member companies Ernst & Young LLP, Deloitte LLP, KPMG and PricewaterhouseCoopers.