Trade Statistics

California is one of the 10 largest economies in the world with a gross state product more than $3.5 trillion. International trade and investment are major parts of our economic engine that broadly benefit businesses, communities, consumers and state government. California’s economy is diverse, and the state’s prosperity is tied to exports and imports of both goods and services by California-based companies, to exports and imports through California’s transportation gateways, and to movement of human and capital resources.

Although trade is a nationally determined policy issue, its impact on California is immense. In 2023, California exported to 227 foreign markets. Trade offers the opportunity to expand the role of California’s exports. In its broadest terms, trade can literally feed the world and raise the living standards of those around us.

According to the United Nations, global trade hit a record high of $32 trillion in 2022. However, trade is expected to slowdown in 2023 due to macroeconomic trends. Ongoing inflation, high interest rates, growing public debt, a precarious geopolitical environment, and US-China decoupling are expected to effect global trade in 2023. While there are some positive factors such as the growth in trade of environmentally friendly goods, improved outlook for major economies, falling shipping costs, and a high demand for services.

|

2023 Trade Statistics are available |

| Monthly U.S. International Trade in Goods and Services, December 2021 Bureau of Economic Analysis, February 8, 2022 |

International Activities

Global Trade Facts

The world population as of January 2023 is 7.95 billion people. As of January 2019, 4.3 births and 1.9 deaths are expected worldwide every second. (U.S. Census Bureau, February 2019)

In October 2023, the World Trade Organization lowered it’s trade growth forecast for 2023 due to a continued slump in global manufacturing. A few days later, the International Monetary Fund followed suit predicting an economic slow down in the next year. The WTO is predicting world merchandise trade to grow by 0.8% this year, a decrease from 1.7% in April, with 2024 growth remaining at 3.3%.

The WTO attributed the trade slow down to be broad-based amidst persistent inflation, continued tight monetary policy, the war in Ukraine, and a strained Chinese property market. However, the WTO is beginning to see evidence of supply chain fragmentation which could threaten the positive outlook for 2024. WTO Director General Ngozi Okonjo-Iweala said “The projected slowdown in trade for 2023 is cause for concern, because of the adverse implications for the living standards of people around the world.”

The IMF similarly is projecting that economic growth will slow to 3% this year, down from 3.5% in 2022, and to 2.9% in 2024, which is a 0.1 downgrade from their 2024 prediction in July of this year. The IMF sees inflation decelerating down to 5.9% in 2023 from 9.2% in 2022, and predicting 4.8% for 2024 with most countries returning inflation to target in 2025. The IMF sees a soft landing as a likely scenario for the global economy and labor markets, although the slowdown has been more pronounced for advanced economies.

The IMF, similar to the WTO, sees geoeconomic fragmentation as posing a risk to the global economy which could have macroeconomic consequences, specifically for the climate transition. The IMF also warns that the Chinese real estate crisis poses a significant risk for the global economy due to diminished consumer confidence and investment in the country.

The IMF believes that multilateral cooperation can help ensure better growth outcomes, recommending that countries should avoid policies that contravene WTO rules and distort international commerce, as well as prevent geoeconomic fragmentation.

In April 2023, the World Trade Organization projected that global trade will slow to 1.7% growth in 2023 following a 2.7% expansion in 2022. Global trade is being weighed down by the effects of the war in Ukraine, stubbornly high inflation, tighter monetary policy and financial market uncertainty.

As of now, the WTO expects trade growth to rebound in 2024 to 3.2%, but is more uncertain than usual due to the continued presence of substantial downside risks, including geopolitical tensions, food supply shocks, and the possibility of unforeseen fallout from monetary tightening.

World Trade Statistical Review

U.S. Trade Facts

In 2022, combined goods and services imports totaled $3.96 trillion, with goods totaling $3.28 trillion and services totaling $680.3 billion individually.

In 2020, combined goods and services exports totaled $3.016 trillion, individually goods exports totaled $2.09 trillion and exports of services totaled $926 billion.

The increases in both exports and imports reflected increases in all major components, led by industrial supplies and materials, mainly petroleum and products.

As a percentage of U.S. gross domestic product, the current-account deficit widened by $97.4 billion, or 11.5 percent, to $943.8 billion in 2022. The deficit was 3.7 percent of current-dollar GDP, up from 3.6 percent in 2021. (Bureau of Economic Analysis)

The United States is the world’s largest economy with a GDP of $25.46 trillion in 2022, according to the Bureau of Economic Analysis. The population of the U.S. is approximately 334.5 million as of March 2023.

For every $1 appropriated to U.S. Commercial Service in Fiscal Year 2016, an estimated $192 was returned to the American economy in the form of increased exports ($56.2 billion) and foreign direct investment ($5.3 billion), which supported approximately 300,000 U.S. jobs.

For every $1 appropriated to U.S. Commercial Service in Fiscal Year 2016, an estimated $192 was returned to the American economy in the form of increased exports ($56.2 billion) and foreign direct investment ($5.3 billion), which supported approximately 300,000 U.S. jobs.

From 2010 to 2016, U.S. Commercial Service assistance played a significant role in helping U.S. companies and localities achieve over $300 billion in U.S. exports and over $23 billion in foreign direct investment – supporting an estimated 1.7 million American jobs.

A 2020 study from the Business Roundtable reported that more than 40 million, or 1-in-5, jobs in the U.S. stem from international trade practices. The number of U.S. jobs that depend on international trade has more than doubled since NAFTA’s inception in 1992, reaching 20% in 2018.

The largest export markets for U.S. goods in 2022 were Canada ($354.9 billion), Mexico ($324.378 billion), China ($153.837), Japan ($80.317), and the United Kingdom ($77.301).

Until just a few years ago, China was easily the largest U.S. trading partner, where individual countries were concerned. But it’s fallen to third place behind Mexico and Canada, as the result of the increased trade friction that began in the Trump administration and prompted companies to diversify their supply chains. The 27 nations of the European Union can also collectively stake a claim to being the largest U.S. trading partner, with Germany the fourth largest just by itself.

In the U.S. in 2021, according to the Bureau of Economic Analysis, expenditures by foreign direct investors to to acquire, establish, or expand U.S. businesses totaled $333.6 billion, an increase of $192.2 billion from 2020 and above the annual average of $289.7 billion from 2014-2020. By industry, expenditures for new direct investment were largest in manufacturing, at $121.3 billion, accounting for 36.4% of total expenditures. Within manufacturing, expenditures were largest in chemical manufacturing ($63.2 billion) and computers and electronic products ($30.2 billion). There were also notable expenditures in the real estate and rental and leasing sector ($43.8 billion).

By country of ultimate beneficial owner (UBO), the largest investing country was the United Kingdom, with expenditures of $59.7 billion. The Netherlands ($43.1 billion) was the second-largest investing country, followed by France ($35.3 billion). By region, Europe contributed 70.0 percent of new investment in 2021.

By state, California received the most investment, totaling $64.1 billion in 2021. In 2020, California had received the second largest expenditures totaling $17.8 billion. (Bureau of Economic Analysis)

Statistics released in August 2021 showed that majority owned U.S. affiliates (MOUSAs) of foreign multinational enterprises employed 7.95 million workers in the U.S. in 2019, which is a 1.1% increase from 2018. Majority owned U.S. affiliates accounted for 6% of total private-industry employment in the U.S. Employment by MOUSAs was largest in the manufacturing and retail trade sectors. MOUSAs with ultimate beneficial owners in the United Kingdom, Japan, and Canada were the largest contributors to total MOUSA employment. (Bureau of Economic Analysis)

For more info on international trade in goods and service.

Source: Bureau of Economic Analysis

California Trade Facts

The U.S. Department of Commerce reported that, in 2022, California exports amounted to $185.55 billion. This was an increase of 6.07% from the previous year’s total of $174.9 billion, according to the U.S. Department of Commerce statistics.

In 2022, exports to FTA markets accounted for 43.3% of California exports. California exports to FTA partners totaled $80.49 billion in 2022. (ITA)

Exports from California accounted for 9% of total U.S. exports in 2022. California exports translate into high-paying jobs for more than 1 million Californians. International trade, including exports and imports, supports more than 5 million California jobs – which translates to 1 in 4 jobs.

In 2020, there were an estimated 18,451 foreign-owned enterprises (FOEs) operating in California, employing 703,187 residents, amounting to $64 billion in wages. Top sources of FDI by foreign-owned enterprises were: Japan (16.4%), the United Kingdom (14.3%), France (9.6%), Germany (8.5%), and Switzerland (7.8%). The top industry sectors for FOEs were manufacturing, professional/business services, wholesale trade, retail trade, and financial activities. (LAEDC)

Top Export Sectors

California is a top exporter in the nation of computers, non-electrical machinery, chemicals, transportation equipment, and agricultural products. Computers and electronic products are California’s top export, which increased by 4.86% to $41.59 billion in 2022.

According to a study by the Consumer Technology Association, in 2017 California had over three million jobs directly and indirectly attributable to consumer tech, many of which derive from consumer tech exports.

Other top exports included: nonelectrical machinery, which also increased by 7.69%, totaling $21.87 billion in 2022. While agricultural products and waste and scrap were the only export products in the top 10 that decreased from 2021 by 0.89% and 20.14%, respectively.

Mexico

Mexico continues to be California’s No. 1 export market. California exports totaled $30.77 billion in 2022. Exports increased by 13.10% compared to 2021. Mexico purchases 16.5% of all California exports.

California’s exports to Mexico are driven by computers and electronic products, which account for 16.3% of all California exports to Mexico. Other top categories included transportation equipment, chemicals and non-electrical machinery.

Canada

Canada is California’s second largest export market, purchasing 10.8% of all California exports. In 2022, California exported more than $20.1 billion to Canada. Exports to Canada increased by 11.4% in 2022 compared to 2021.

Computers and electronic products remained California’s largest exports, accounting for 25% of all California exports to Canada.

Asia

California is the second largest exporting state to Asia, after Texas. In 2022, California exported $78.737 billion in goods to the region.

Greater China

California exports to Mainland China totaled $18.15 billion in 2022, a 9.12% increase from the year before. Computers and electronic products was the largest export to China accounting for 22% of exports.

Exports to Hong Kong were $5.55 billion in 2022, a significant decrease of 17.73% from the previous year. Hong Kong was California’s 10th largest export market.

Japan

California exports to Japan totaled $11.607 billion in 2022. Exports decreased by 1.6% between 2021 and 2022. Computers and electronic products accounted for 18% of total exports.

South Korea

South Korea maintained the spot of California’s No. 5 trading partner as California exported $11.58 billion in 2022, a 0.27% decrease compared to 2021. Over 30.5% was made up of non-electrical machinery.

European Union

California exports to the European Union (excluding the UK) totaled $26.945 billion in 2022. California is a top exporting state to Europe.

Computers and electronic products, chemicals, agricultural products, and miscellaneous manufactures are California’s leading export sectors to the region. European Union countries purchase about 14.5% of all California exports.

Export Totals from California

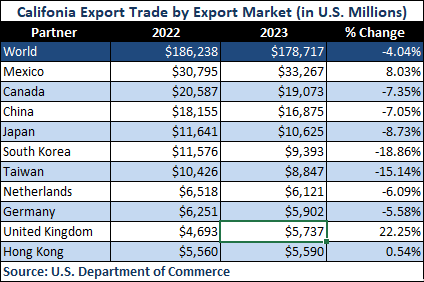

In 2023, California exported $178.717 billion to 227 foreign economies. California’s top export markets are Mexico, Canada, China, Japan and South Korea.

Import Totals from California

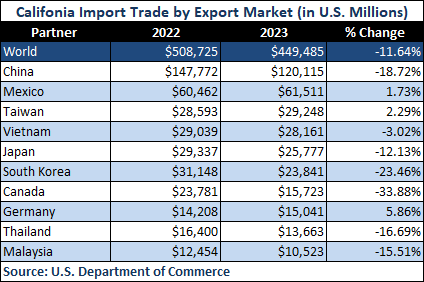

In 2023, California imported $449.485 billion worth of goods from the world. California’s top sources of imports are China, Mexico, Taiwan, Vietnam and Japan.

USMCA Tracker Data Tool from the Brookings Institute

War Dims Global Economic Outlook as Inflation Accelerates

International Monetary Foundation, April 19, 2022

World Bank Cuts 2022 Global Growth Outlook on Russia Invasion

Bloomberg, April 18, 2022

Global Economic Uncertainty, Surging Amid War, May Slow Growth

International Monetary Foundation, April 15, 2022

Addressing Challenges to Growth, Security and Stability – Scene-Setter Speech by World Bank Group President David Malpass

World Bank, April 12, 2022

Trade and American Jobs: The Impact of Trade on U.S. and State-Level Employment: 2022 Update

Business Roundtable, February 2022

Mad About Trade: Why Main Street America Should Embrace Globalism

CATO Institute

Cato Institute Project on Jones Act Reform

CATO Institute

WTO Trade Statistics 2019 Editions

Additional Information

- California Agriculture Export Data – CDFA & UC Davis

- California Dept of Finance – California Trade Data

- California Dept of Finance – Economic Indicators

- California Travel & Tourism Commission – International Travel Reports

- California Tourism Facts and Figures

Visit California - International Trade Administration – International Tourism and Travel

- InvestAmerica

- Organization for International Investment

- Trade and American Competitiveness Coalition Statistics

- Trade Partnership Worldwide

- U.S. Bureau of Labor Statistics – California Economic Data

- U.S. Bureau of Transportation Statistics

- U.S. Census Bureau Foreign Trade Statistics

- U.S. Department of Agriculture – California Economic Data

- U.S. Department of Commerce – California Trade Stats

- US Department of Commerce -Small and Medium-Sized Exports by Market

- U.S. Department of Commerce – TradeStatsExpress

- U.S. Department of Commerce – U.S. Census Bureau Trade in Goods and Services (pdf)

- U.S. Department of Commerce – Trade and Economic Analysis

- U.S. Waterborne Import-Export Trade Data

- Wiser – Foreign Trade Database

- World Trade Organization – Country Trade Profiles