Trading Partner Portal: Zambia

Overview

Zambia-U.S. State-Level The Zambia Investment & Innovation Roadshow 2025 is a high-level, multi-state U.S. tour focused on catalyzing bilateral engagement between Zambia and U.S. state actors. The roadshow will visit three key states—California, Texas, and Georgia—each selected for their unique economic strengths and potential synergies |

Trade Overview

The Republic of Zambia is a south-central African country that is rich with natural resources. Mining has been one of larger economic industries, specifically in copper, but it has begun to diversify its economy in industries such as energy, infrastructure, information & communication technologies, travel and tourism, and agriculture.

The Republic of Zambia is a south-central African country that is rich with natural resources. Mining has been one of larger economic industries, specifically in copper, but it has begun to diversify its economy in industries such as energy, infrastructure, information & communication technologies, travel and tourism, and agriculture.

It is a politically stable, multi-party democracy with a population, currently 21.31 million people as of 2024, that is expected to double by 2050. It’s GDP as of 2024 is $26.33 billion according to the World Bank, with GDP per capita equaling $1,235. Zambia’s GDP dropped in 2024 to $26 billion from about $30 billion due to the severe 2024 drought in the country’s history, which adversely affected the growth of all sectors.

It is bordered by eight nations, offering market access to over 350 million consumers in SADC and COMESA. With 70% of its population under the age of 30 and reforms under the 2022 ZDA Act, it has begun to be a premier hub of trade and investment in Africa.

U.S. – Zambia Trade

Two-way goods trade between the United States and Zambia totaled $282 million in 2024. Goods exports from the U.S. to Zambia equaled $114 million. Top exports were non-electrical machinery ($44 million), transportation equipment ($23 million), computer & electronic products ($14 million), other special classification provisions ($7 million), and plastics & rubber products ($6 million).

In this same year, goods imports totaled $169 million. The top imports from Zambia to the U.S. were miscellaneous manufactures ($127 million), primary metals manufactures ($28 million), agricultural products ($10 million), goods returned ($1 million), and livestock & livestock products ($1 million).

California – Zambia Trade

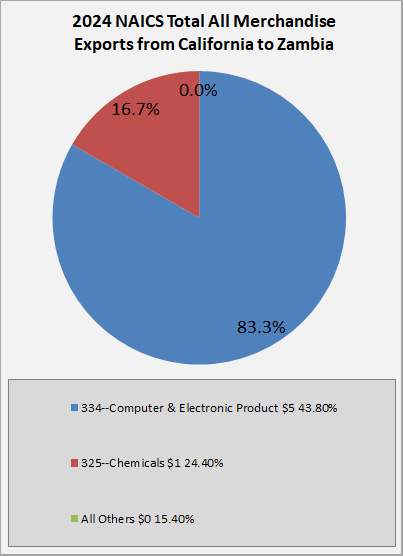

As of 2024, Zambia is California’s 142nd export partner, with total goods exports equaling $6 million. Computer and electronic products were the largest export category, totaling $5 million. Chemicals were the second largest category at $1 million, while used or second-hand merchandise, electrical equipment, appliances & components, and fabricated metals products all came in at less than $1 million.

Goods imports in this same year from Zambia to California totaled $9 million. Top imports were miscellaneous manufactures ($7 million), agricultural products ($2 million), livestock & livestock products (less than $1 million), gods returned (less than $1 million) and used or secondhand merchandise (less than one million).

FDI – Zambia

Zambia is open to foreign direct investment and U.S. interest lie in many of its sectors, especially in mining. Zambia has signed Bilateral Investment Treaties with 16 different countries, with 10 in force and 6 pending. Its primary investment sectors are mining and critical minerals, green energy and power, agriculture, manufacturing, and tourism.

The U.S.’s direct investment position increased in 2024 by just over 13%, making its total outward position in Zambia to $102 million. BEA

Zambia holds as the 7th largest copper producer globally, with 6% of local reserves, and 20% or the worlds emeralds. It also holds critical minerals such as cobalt, uranium, and hydrocarbons. Its green energy and power sector is one of the fastest growing with the Zambian government estimating roughly 6,000 MW of unexploited hydro potential, 2,300 MW for solar, and 3, 000 MW of wind generation capacity. Its electricity demand grows roughly 3% annually.

Its agricultural sector is also growing with the Zambia holding 42 million hectares of arable land, with only 1.5 million cultivated. This is highlighted as well, because Zambia holds 40% of all water resources in SADC. Its manufacturing sector contributes 8% to GDP, with a focus on food, textiles, wood, paper, chemicals, and light industrials.

Zambia’s tourism industry is also growing, primarily in eco-tourism, as it holds the Victoria falls, an UNESCO World Heritage site, and 20 national parks spanning 23 million hectares.

Zambia’s investment climate is especially notable for the following:

-

- Pro-Business Policies: No price, FX, or interest rate controls; 100% profit repatriation.

- Tax Incentives:

- 0% tax on export profits for tourism and mining companies.

- 0% tax on profits/dividends for companies in industrial parks.

- VAT refunds for manufacturing exports.

- 10-year carry-forward for mining losses.

- Claim, on a straight-line basis, wear and tear at an accelerated rate not exceeding one hundred percent (100%) in respect of any new implement, plant or machinery.

- Market Access: Preferential access through AGOA, AfCFTA, and regional blocs

Other Articles:

Zambia Launches Landmark “Invest in Zambia International Conference” to Drive Economic Transformation

Lusaka Times, July 17, 2025

Guideline on Facilitation and registration of investment in Zambia (pdf.)

Trade Agreements

Trade Agreements

Zambia is a member of the 21-member Common Market for Eastern and Southern Africa (COMESA), the 16-member Southern African Development Community (SADC), and the African Tripartite Free Trade Area Agreement, and the African Continental Free Trade Agreement (AfCFTA). It is also eligible for U.S. trade benefits under African Growth and Opportunity Act (AGOA) and the former General System of Preferences (GSP).

Zambia has also been a member of the WTO since its inception in 1995; it holds duty and quota-free access to EU markets.

AGOA – African Growth and Opportunity Act

The African Growth and Opportunity Act was put into force on May 18, 2000, and has been renewed on many different occasions, the most recent being in 2015. It was extended to September of 2025 and is currently under review.

Zambia is one of the countries under AGOA that expands market access to the U.S. for qualifying Sub-Saharan African countries to allow U.S. importers to clear goods under specific tariff lines duty-free. These preferences build on the U.S. Generalized System of Preferences (GSP), which is still pending reauthorization.